What is a Crypto Wallet? Understanding Types, Functions, and Security Features

Cryptocurrencies have transformed the way we think about money, but to safely manage these digital assets, one crucial tool is needed: the crypto wallet. A crypto wallet allows users to store, send, and receive digital currencies like Bitcoin, Ethereum, etc. But with the plethora of wallet types and features available, understanding how they work and which is best suited for your needs is essential.

A crypto wallet is a digital tool that allows users to store, manage, and transact cryptocurrencies like Bitcoin, Ethereum, and other digital assets. It doesn't physically hold cryptocurrencies but stores the private and public keys required to access blockchain addresses and authorize transactions. Crypto wallets come in various forms, including software (web, mobile, desktop apps), hardware devices, and even paper, each offering different levels of convenience and security.

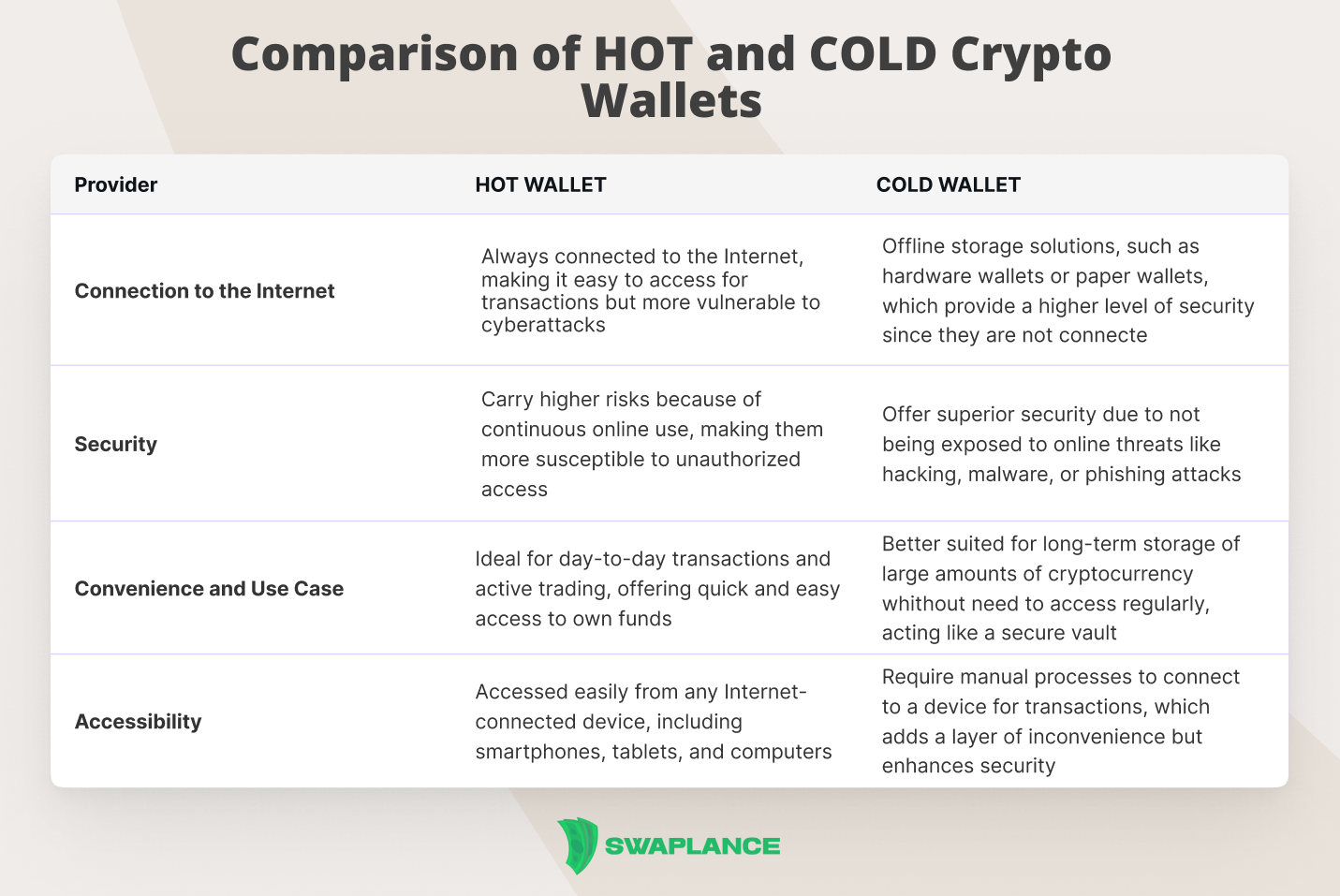

Crypto wallets can be categorized as hot wallets, which are connected to the internet and ideal for frequent trading, and cold wallets, which are offline and highly secure, making them suitable for long-term storage. The main functions of a crypto wallet include sending and receiving digital currency, monitoring balances, and managing multiple cryptocurrency addresses. Proper security measures, such as two-factor authentication and secure private key management, are crucial for protecting assets stored in a crypto wallet.

What is the Best Crypto Wallet?

When determining what is the best crypto wallet, it’s important to consider security, ease of use, supported cryptocurrencies, and specific needs like staking or DeFi access. Some of the most popular and highly regarded wallets include:

- Ledger Nano X: A hardware wallet known for its robust security features, offline storage, and comprehensive support for various cryptocurrencies.

- Trezor Model T: Another leading hardware wallet offering a user-friendly interface and strong security with an intuitive touchscreen.

- Exodus: A software wallet that's user-friendly, ideal for beginners, and supports a wide range of digital assets, though it lacks the heightened security of hardware wallets.

- Trust Wallet: A popular mobile wallet that supports multiple cryptocurrencies, including ERC-20 tokens, and integrates seamlessly with decentralized applications (dApps).

- MetaMask: Primarily used for Ethereum and ERC-20 tokens, MetaMask is favored for interacting with the Ethereum blockchain and accessing decentralized finance (DeFi) platforms.

Choosing the best wallet depends on what you value most: security, convenience, or compatibility with specific blockchains. If you’re wondering what the best wallet for crypto is exactly for you, the answer will vary depending on your individual needs and risk tolerance.

How to Get a Crypto Wallet

To get a crypto wallet, start by deciding on the type of wallet that best suits your needs—hot (online) or cold (offline). Hot wallets are generally easier to set up and access but are less secure than cold wallets. Here's how to get a crypto wallet:

- Download a Software Wallet: For beginners, downloading a software wallet like Trust Wallet or Exodus from the official app store is an easy way to start. Ensure you download it from a verified source to avoid phishing scams.

- Purchase a Hardware Wallet: For enhanced security, purchase a hardware wallet such as Ledger or Trezor directly from the manufacturer’s website to avoid counterfeit devices.

- Sign Up on an Exchange: Some platforms, like Coinbase and Binance, offer built-in wallets when you sign up for an account. These are convenient, but remember that the exchange controls the private keys, not you.

Understanding how to open a crypto wallet is the first step toward securing your digital assets.

How to Set Up a Crypto Wallet

Setting up a crypto wallet involves several steps that ensure your digital assets are secure. Here’s a guide on how to set up a crypto wallet, whether you’re using a software or hardware wallet:

- Download and Install: For software wallets, download the app from an official source, install it, and follow the setup instructions. Connect the device to your computer or mobile device for hardware wallets and download the corresponding app (e.g., Ledger Live for Ledger devices).

- Create or Restore a Wallet: If you're setting up a new wallet for the first time, choose to create a new one or restore an existing wallet using your recovery seed phrase if you’ve used one before.

- Secure Your Seed Phrase: During setup, your wallet will generate a seed phrase (12-24 words). Write this down on paper and store it in a secure place, as it is the only way to recover your wallet if lost.

- Set Up Passwords and PINs: Set strong passwords or PINs for added security, especially if you’re using a software wallet.

- Backup Your Wallet: Always back up your wallet settings and seed phrase to prevent loss in case your device fails.

Knowing how to create a crypto wallet properly ensures your assets are protected from theft or loss. If you need advice on choosing the right crypto wallet for your needs or help installing it, the Swaplance freelance experts are always at your service.

What is a Cold Wallet in Crypto?

A cold wallet, also known as cold storage, is a type of crypto wallet that stores digital assets offline, making it highly secure against online threats like hacking and malware. Unlike hot wallets, which are connected to the internet, cold wallets keep private keys away from online access, reducing the risk of unauthorized access. Common examples of cold wallets include hardware wallets (like Ledger and Trezor) and paper wallets, which involve printing the wallet's private keys and storing them physically. Cold wallets are ideal for long-term storage of large amounts of cryptocurrency because they offer maximum security, although they are less convenient for frequent transactions due to their offline nature.

Cold wallets, like Ledger and Trezor, offer the highest level of security because they are immune to hacking attempts that typically target online wallets. Although less convenient for frequent transactions, they are ideal for long-term storage of significant crypto holdings.

How to Transfer Crypto from Coinbase to Coinbase Wallet

Transferring crypto from Coinbase to Coinbase Wallet is a straightforward process that involves a few simple steps. Here's how to do it:

- Install and Set Up Coinbase Wallet: Ensure that the Coinbase Wallet app is installed on your mobile device or browser extension. Set up your wallet by creating a new account or connecting to your existing one. Remember to back up your recovery phrase securely during this process.

- Log into Coinbase: Open your Coinbase account via the mobile app or website and log in with your credentials.

- Initiate the Transfer: In your Coinbase account, go to the "Assets" or "Portfolio" section, select the cryptocurrency you want to transfer and tap "Send" or "Transfer."

- Enter the Coinbase Wallet Address: When prompted, enter your Coinbase Wallet address. To find your wallet address, open the Coinbase Wallet app, select the cryptocurrency you want to receive and click "Receive." Copy the address and paste it into the sender field in your Coinbase account.

- Confirm the Transfer: Review the transaction details, including the amount and the address, then confirm the transfer. Coinbase may prompt you to verify your identity via two-factor authentication.

- Wait for Confirmation: The transfer usually takes a few minutes, but the time can vary depending on network congestion. Once confirmed, your crypto will appear in your Coinbase Wallet.

Always double-check the wallet address before confirming the transaction to avoid sending funds to the wrong address, as crypto transactions are irreversible.

This process is often referred to as how to move crypto from Coinbase to wallet and allows you to take control of your funds, keeping them safe from potential exchange vulnerabilities.

Conclusion

Choosing the right crypto wallet and understanding its functions are essential for securely managing your digital assets. From knowing what the best crypto wallet is to understanding the steps to create and maintain one, you can effectively safeguard your investments. Whether you opt for a cold storage solution or a convenient software wallet, prioritizing security and being aware of setup procedures will go a long way in protecting your crypto.

Common questions

-

How secure are crypto wallets, and what are the risks?Crypto wallets are generally secure, but their security largely depends on the type of wallet and how it is managed. Hardware wallets, or cold wallets, are considered the most secure because they store private keys offline, making them less vulnerable to hacks. However, users must keep their recovery phrases safe, as losing them can result in permanent loss of access to funds. Software wallets, while convenient, are more susceptible to cyber threats such as phishing, malware, and hacking attacks. The main risks associated with crypto wallets include unauthorized access due to weak passwords, phishing scams, and the potential loss of funds due to mismanagement or hardware failure. To enhance security, users should enable two-factor authentication, use reputable wallets, and regularly update their software.

-

What are the differences between hot and cold crypto wallets?Hot and cold crypto wallets differ primarily in storing and managing digital assets. Hot wallets are connected to the internet, making them convenient for quick transactions and easy access but more vulnerable to cyberattacks, hacking, and malware. Examples of hot wallets include mobile apps, desktop wallets, and web-based wallets. On the other hand, cold wallets are offline storage solutions like hardware wallets or paper wallets, offering a higher level of security by keeping private keys disconnected from the internet. This makes cold wallets less convenient for frequent transactions but highly secure against online threats. The main trade-off between hot and cold wallets is the balance between security and accessibility, with hot wallets prioritizing ease of use and cold wallets focusing on safeguarding assets.

-

Can you store multiple cryptocurrencies in one wallet?Yes, you can store multiple cryptocurrencies in one wallet, especially if the wallet supports multi-currency functionality. Many modern crypto wallets, such as hardware wallets (like Ledger and Trezor) or software wallets (like Exodus and Trust Wallet), are designed to handle a wide range of cryptocurrencies, allowing users to manage Bitcoin, Ethereum, and numerous other altcoins all in one place. This makes tracking and managing different assets convenient without needing separate wallets for each coin. However, the range of supported cryptocurrencies varies between wallets, so it's important to choose a wallet that supports the specific cryptocurrencies you plan to store.

Mark Petrenko

Mark Petrenko