How to Wire Money with Bank of America

Sending money through wire transfers is a common and secure method for transferring funds either domestically or internationally. Bank of America provides a reliable and relatively straightforward process for wiring money, including domestic and international transfers. Here is a comprehensive guide covering all aspects of wire transfers with Bank of America, including the steps involved, fees, and tips for ensuring smooth transactions.

Understanding Wire Transfers with Bank of America

A wire transfer is a method of electronically transferring funds between banks or financial institutions. When you initiate a wire transfer with Bank of America, your bank transfers the money directly from your account to the recipient's bank account. Unlike ACH (Automated Clearing House) payments, wire transfers are processed in real-time, meaning the funds are transferred almost immediately. To complete a wire transfer, you will need specific details, including the Bank of America wire address for international transactions, which ensures your funds reach the correct destination.

It’s important to recognize that a wire transfer is a secure and efficient method of sending money electronically from one bank to another, both domestically and internationally. With Bank of America, wire transfers can be initiated through online banking, the mobile app, or by visiting a branch. You will need details such as the recipient’s name, bank account number, and the receiving bank’s routing number for domestic transfers or their IBAN and SWIFT code for international transfers.

Accurately inputting all necessary details, including the recipient’s bank information, and submitting the transfer request before the cut-off time (usually around 5 PM) for same-day processing are the most critical aspects of ensuring a smooth transaction.

How to Set Up a Wire Transfer with Bank of America

To set up a wire transfer with Bank of America, you will need to provide certain key details. These include the recipient’s full name, address, account number, and the receiving bank's wire routing number. You’ll also need to include the recipient's International Bank Account Number (IBAN) and the bank's SWIFT/BIC code for international transfers. Wire instructions for Bank of America are available on the bank’s website or can be provided by customer service.

To complete a wire transfer:

- Log into your Bank of America online banking account or mobile app.

- Select the "Transfer/Zelle" tab.

- Click "Make a Transfer" and choose the wire transfer option.

- Enter the recipient’s details and follow the on-screen prompts to complete the transaction.

Domestic Wire Transfers: Step-by-Step Guide

For domestic transfers within the United States, follow this wire transfer BoA guide:

- Log in to Your Online Banking Account: Start by logging into your Bank of America account via the online portal or mobile banking app.

- Navigate to Transfers: Once logged in, locate the "Transfers" tab, typically found in the main menu. From there, select "Send Money" or "Wire Transfer."

- Enter Recipient Information: You will need the recipient’s full name, bank name, account number, and the Bank of America wire address. Ensure that you have accurate details to avoid delays or rejections.

- Choose Domestic Wire Transfer: Select the "Domestic Wire Transfer" option, which covers transfers within the U.S. You will need to provide wire instructions for Bank of America, including details of the recipient's account and bank.

- Specify the Transfer Amount: Enter the amount you wish to send. Bank of America may ask you to confirm the transfer limits, which can vary depending on your account type and relationship with the bank.

- Review Fees: Review any applicable fees for a domestic wire transfer (often around $30 for Bank of America). Make sure you're aware of the exact costs.

- Confirm and Submit: Double-check all details, including recipient information, transfer amount, and fees. Once confirmed, submit your wire transfer request.

- Save Confirmation: You’ll receive a confirmation receipt or email upon submission. Save this information in case you need to track the transaction.

With Bank of America, domestic wire transfers are typically processed the same day if submitted before the cutoff time (5 PM ET). Transfers initiated after this time may be processed the following business day.

International Wire Transfers: Step-by-Step Guide

The process is similar for international transfers but requires additional information due to cross-border regulations. Here is the wire transfer international Bank of America step-by-step guide:

- Log in to your online account: As with domestic transfers, you will start by logging into your Bank of America account.

- Choose the wire transfer option: Under the “Transfer” section, select “International Wire Transfer.”

- Enter the recipient’s international banking details: This includes the recipient’s name, address, IBAN, and the SWIFT/BIC code of the recipient's bank.

- Complete the transfer: Review and confirm the details before submitting.

International transfers may take several business days, depending on the destination country and intermediary banks.

Bank of America Wire Transfer Fees and Charges

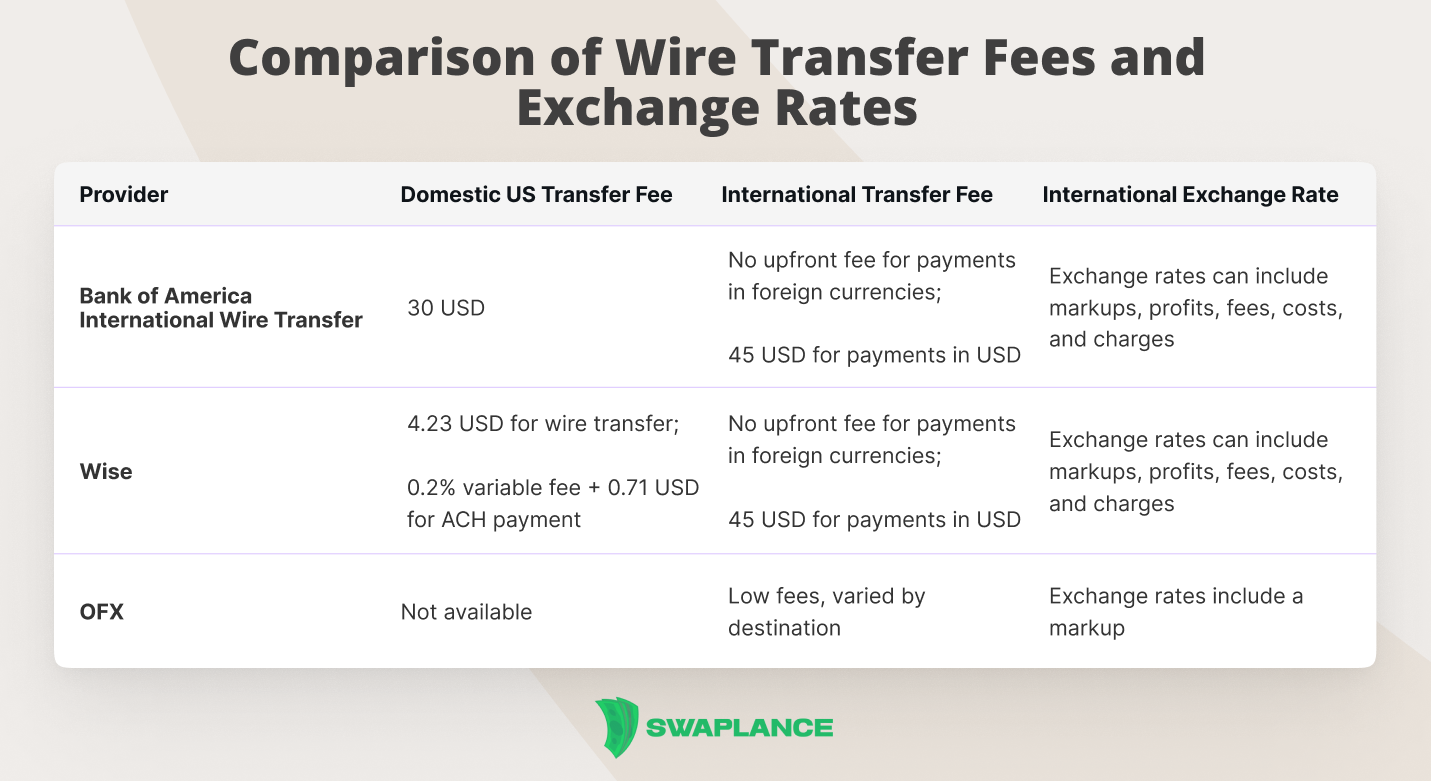

Wire transfer fees vary based on whether the transfer is domestic or international. Below is a breakdown of common fees:

- Domestic Wire Transfer Fee: Bank of America charges a fee for sending domestic wire transfers, which typically ranges between $25 and $30, depending on the account type.

- International Transfer Bank of America Fee: Fees for international transfers are usually higher, often around $35 to $45. Additionally, intermediary banks may charge a fee.

- Bank of America Foreign Wire Transfer Fee: For foreign currency transfers, the exchange rate will also impact the total cost in addition to any fees incurred. Always check for hidden charges related to currency conversion.

How Long Does an International Wire Transfer Take?

One of the most common questions asked is how long does international wire transfer take Bank of America.

Typically, domestic wire transfers are processed within 1-2 business days.

International wire transfers with Bank of America typically take 2 to 5 business days to process, depending on the destination country and the receiving bank. Several factors can influence the transfer time, including the time of day the transfer is initiated (whether it's before or after the bank's cutoff time) andnt country.

Transfers initiated before th for international transfers in foreign currencye Bank of America's cut-off time, usually around 5 PM Eastern Time, are more likely to be processed on the same day. Delays might occur if there are public holidays or weekends in the sender's or recipient's countries, which can slow down the processing time.

In summary, while the standard processing window is 2-5 business days, certain factors, such as public holidays and accurate information, can affect this time frame.

Tips for Ensuring a Smooth Wire Transfer Process

To avoid potential issues or delays, follow these wire instructions for Bank of America:

- Double-check the recipient’s details: To avoid errors, ensure that the IBAN, SWIFT/BIC, and account number provided are accurate.

- Submit before the cut-off time: Bank of America typically has a cut-off time of 5 PM for same-day processing. Transfers made after this time may be delayed.

- Consider intermediary bank fees: If you are sending an international wire transfer, remember that intermediary banks may charge fees that are outside Bank of America's control.

- Verify the currency conversion rate: For international transfers in foreign currency, Bank of America applies a conversion rate, so it’s important to know the exact rate and how it affects the overall transfer cost.

In conclusion, wiring money with Bank of America is a straightforward process, whether you are sending funds domestically or internationally. The key is to have all the correct information ready, such as the recipient’s account number and bank details, and to be aware of the associated fees. With this wire transfer costs overview, you now understand how much you can expect to pay and how long transfers might take. For more specialized help with setting up and managing wire transfers, Swaplance offers freelance experts who can assist with ensuring a smooth and cost-effective process.

Common questions

-

Can I initiate a Bank of America wire transfer online, or do I need to visit a branch?Yes, you can initiate a Bank of America wire transfer online through their online banking platform or mobile app. You do not need to visit a branch to set up most wire transfers. The process involves logging into your account, selecting the transfer option, entering the necessary details like the recipient's bank information, and confirming the transfer. However, for certain transactions, particularly international ones, you may need additional authentication or assistance from the bank, which may involve visiting a branch.

-

What information do I need to provide for a wire transfer with Bank of America?To initiate a wire transfer with Bank of America, you'll need to provide several key details. For domestic transfers, you'll need the recipient's full name, their bank's routing number, and their account number. For international wire transfers, in addition to the recipient’s name and account number, you’ll also need the SWIFT/BIC code of the recipient's bank and possibly the recipient's IBAN (International Bank Account Number) if the country uses one. Additionally, you may need to specify the recipient’s bank address, particularly for international transfers.

-

Are there any limits on the amount I can transfer via wire with Bank of America?Yes, Bank of America typically imposes limits on the amount you can transfer via wire, though the exact limit depends on various factors such as the type of account and whether the transfer is domestic or international. For domestic transfers, the limit can range from $1,000 to $100,000 per day for online transfers, while higher amounts may require visiting a branch. International wire transfers generally have lower limits compared to domestic ones. Additionally, business accounts often have higher wire transfer limits than personal accounts. You can check specific transfer limits by logging into your Bank of America account or consulting with the bank directly.

Mark Petrenko

Mark Petrenko