How Open Banking and Bank APIs Are Boosting Fintech Growth

The financial services industry is undergoing a transformative shift driven by technological advancements, with open banking and bank APIs (Application Programming Interfaces) at the forefront. These innovations are unlocking new opportunities for fintech companies, allowing them to deliver enhanced customer services, improve financial inclusion, and create more competitive markets. This article explores the key concepts, benefits, and future trends of open banking and bank APIs and how they fuel fintech growth.

What Is API in Banking?

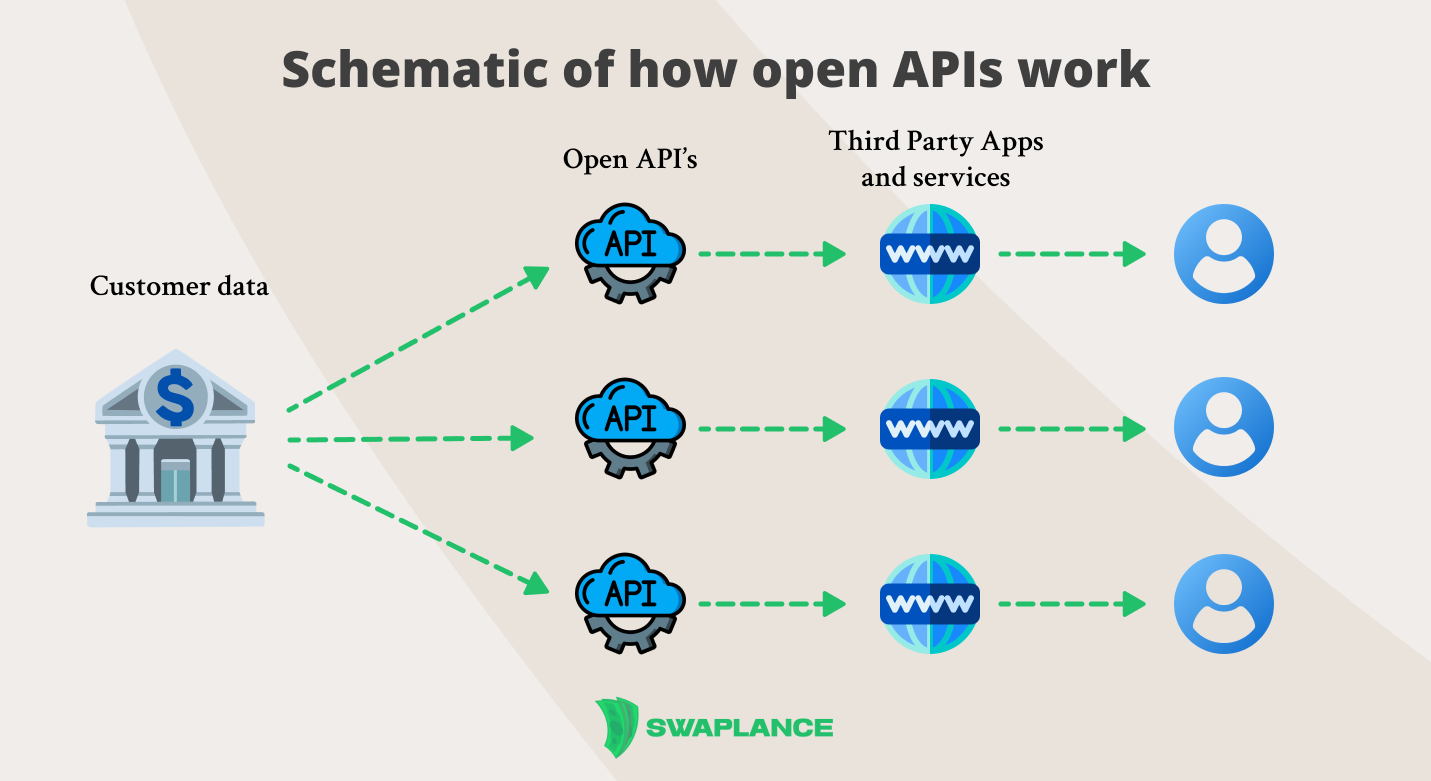

In banking, API, or Application Programming Interface is a set of protocols and tools that allow different software applications to communicate with each other. API in banking means that third-party developers, fintech companies, and other financial institutions can access bank services and data securely and standardized. This interaction allows the creating of new financial products, services, and integrations that can enhance the customer experience and streamline banking operations.

APIs in banking can be public, private, or partner APIs. Public APIs are available to external developers, allowing them to build applications that interact with the bank's services. The bank uses Private APIs internally to improve its operations and customer service. Partner APIs are shared with specific business partners to facilitate collaboration and the development of joint products.

How Does API Work in Banking?

Application Programming Interface in banking acts as intermediaries that facilitate the exchange of information between different systems. For example, when a customer uses a mobile banking app to check their account balance, the app sends a request to the bank's server via an API. The API processes this request, retrieves the relevant data from the bank's database and sends it back to the app, which then displays the information to the user.

APIs can be used for a wide range of banking functions, including:

- Account Management: APIs allow customers to view their account balances, transaction histories, and other financial information.

- Payments: APIs enable the initiation and processing of payments, such as transferring money between accounts or making online purchases.

- Identity Verification: APIs can be used to authenticate users and verify their identities when accessing banking services.

- Data Sharing: APIs facilitate the secure sharing of customer data with third-party applications, enabling the development of personalized financial services.

Benefits of API Banking

API banking offers several benefits to both financial institutions and their customers:

- Enhanced Customer Experience: By leveraging APIs, banks can offer their customers more personalized and seamless experiences. For example, fintech apps can use banking APIs to provide users with a comprehensive view of their finances, helping them manage their money more effectively.

- Innovation and Flexibility: APIs allow banks to quickly integrate new technologies and services, enabling them to stay competitive in a rapidly changing market. Fintech companies can use APIs to develop innovative solutions that meet consumers' evolving needs.

- Cost Efficiency: API banking reduces the need for banks to develop and maintain in-house software for every service. Instead, they can integrate third-party solutions through APIs, saving time and resources.

- Increased Collaboration: APIs foster collaboration between banks and fintech companies, allowing them to combine their strengths and offer more comprehensive financial services. This collaboration can lead to the development of new business models and revenue streams.

Open Banking and Its Impact on Fintech

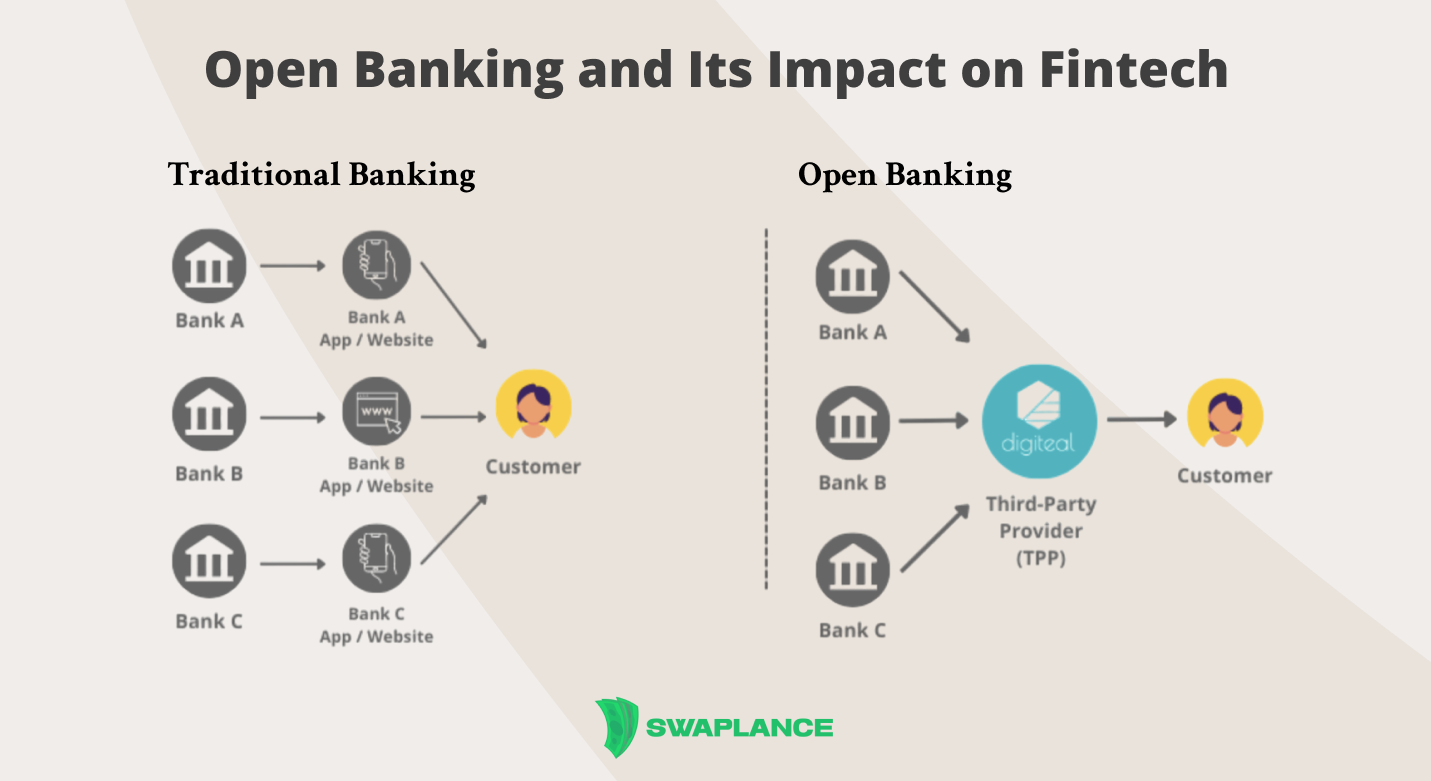

To understand how open banking boosts fintech, let's remind what is open banking. Open banking is a regulatory framework that mandates banks to share customer data with third-party providers through secure APIs, provided that the customer consents. This initiative aims to increase competition in the financial services sector, promote innovation, and improve consumer access to financial products.

For fintech companies, open banking is a game-changer. It levels the playing field by giving them access to the same data previously exclusive to traditional banks. This access allows fintechs to develop new services, such as budgeting apps, payment solutions, and credit scoring tools, that can better meet the needs of consumers.

Moreover, open banking encourages collaboration between banks and fintech companies, creating new products and services that enhance the customer experience. By integrating open APIs in banking, fintech companies can offer more personalized and efficient financial solutions, helping them attract and retain customers.

Examples of API Banking Solutions

Several fintech companies and platforms have successfully integrated API banking solutions to offer innovative financial services. Here are a few examples:

- Plaid is a fintech company that provides APIs enabling developers to connect with users' bank accounts. Its API powers many popular apps, such as Venmo and Robinhood, by facilitating account verification, transaction monitoring, and payment initiation.

- Tink is a European open API banking platform that offers APIs for account aggregation, payment initiation, and data enrichment. It allows fintechs and banks to build financial products that provide better insights and control to their customers.

- Yapily is another open API banking platform that provides a range of APIs for financial data access, payment processing, and compliance with open banking regulations. It enables fintech companies to offer a seamless and secure user experience.

Challenges and Risks in API Banking

While API banking offers numerous benefits, it also presents several challenges and risks:

- Security Concerns: APIs, which handle sensitive financial data, are potential cyberattack targets. Banks and fintech companies must implement robust security measures, such as encryption and authentication, to protect against breaches.

- Regulatory Compliance: Banks and fintechs must navigate complex regulatory landscapes when integrating APIs, particularly in regions with stringent data protection laws. Ensuring compliance can be resource-intensive and may slow down the development process.

- Data Privacy: Sharing customer data through APIs raises privacy concerns. Banks and fintechs must ensure they have obtained proper customer consent and that their data is handled securely.

- Integration Complexity: Integrating APIs into existing banking systems can be challenging, particularly for legacy banks with outdated infrastructure. This complexity may require significant investment in technology and expertise.

- Reliability and Downtime: API performance and reliability are critical, as any downtime or failure can disrupt financial services and harm customer trust. Banks and fintechs must ensure that their APIs are resilient and well-maintained.

Future Trends in API Banking

The future trends in API banking are bright, with several of them expected to shape API banking growth:

- Expansion of Open Banking: Open banking will likely expand globally, with more countries adopting similar frameworks. This expansion will create new opportunities for fintech companies to innovate and offer cross-border financial services.

- Artificial Intelligence and Machine Learning will play a significant role in API banking, enabling more sophisticated data analysis, fraud detection, and personalized financial services.

- Blockchain Integration: Blockchain technology could be integrated with APIs to enhance security, transparency, and efficiency in banking. This integration could lead to new applications in areas such as cross-border payments and smart contracts.

- APIs as a Service: The rise of APIs as a service will allow fintechs to access banking capabilities without building or maintaining their own infrastructure. This trend will lower the barrier to entry for new fintech companies.

- Increased Collaboration: Collaboration between banks, fintech, and technology providers will continue to grow, leading to the development of more innovative and customer-centric financial products.

In conclusion, open banking and bank APIs are revolutionizing the financial services industry by enabling more significant innovation, collaboration, and customer empowerment. As these technologies continue to evolve, they will play a pivotal role in the growth of fintech and the future of banking. Platforms like Swaplance are instrumental in this transformation, providing the expertise and resources needed to integrate open banking and APIs into business operations helping companies stay competitive in a rapidly changing landscape.

Common questions

-

How are small businesses leveraging open banking and bank APIs?Small businesses are increasingly leveraging open banking and bank APIs to streamline operations, improve financial management, and enhance customer experiences. By integrating these technologies, they can access real-time financial data, automate accounting processes, and offer more flexible payment options to their customers. Additionally, open banking allows small businesses to access a wider range of financial services, such as instant loans and personalized financial products, which were previously only available to larger enterprises. This democratization of financial services enables small businesses to compete more effectively in the market.

-

What security measures are in place for API banking?Security measures in API banking are robust to protect sensitive financial data and transactions. Key measures include strong authentication protocols, such as multi-factor authentication (MFA), to ensure that only authorized users can access the APIs. Encryption is widely used to secure data both in transit and at rest, safeguarding it from interception or unauthorized access. Additionally, API gateways and monitoring systems help detect and prevent malicious activities. At the same time, strict compliance with regulatory standards like PSD2 ensures that financial institutions adhere to the highest levels of security and data protection.

-

How do bank APIs facilitate the development of new financial products?Bank APIs facilitate the development of new financial products by providing secure and standardized access to a bank’s financial infrastructure and data. This allows third-party developers to create innovative services, such as budgeting apps, payment solutions, and lending platforms, by integrating with existing banking systems. APIs enable faster and more cost-effective product development by leveraging the bank’s infrastructure rather than building from scratch. Additionally, APIs allow for real-time data exchange, enhancing the ability to offer personalized financial products tailored to individual customer needs. This collaborative ecosystem fosters a more dynamic and competitive financial services market.

Mark Petrenko

Mark Petrenko