What Is an FBO Account: A Pillar of Modern FinTech and Banking

An FBO Account (For the Benefit Of Account) is a specialized financial structure that serves as a cornerstone in modern fintech and banking. It is an account where funds are held by one entity, such as a fintech company, for the exclusive benefit of another party, typically the end customer. This setup ensures that client funds are segregated and managed securely under a master account, providing transparency and safeguarding the interests of the beneficiaries. As a pivotal element in fintech, FBO accounts facilitate efficient and compliant management of customer funds, playing a crucial role in the evolving landscape of digital financial services.

What is an FBO Account?

An FBO account is a type of bank account where funds are held by one entity (often a financial institution or a fintech company) on behalf of another party, such as individuals or businesses. The FBO meaning in banking refers to accounts used to manage pooled funds, where the bank account is in the company's name, but the funds belong to the company's clients or users. This structure is typical in industries where managing client funds, such as fintech, insurance, or payment processing, is essential.

FBO Accounts in Banking

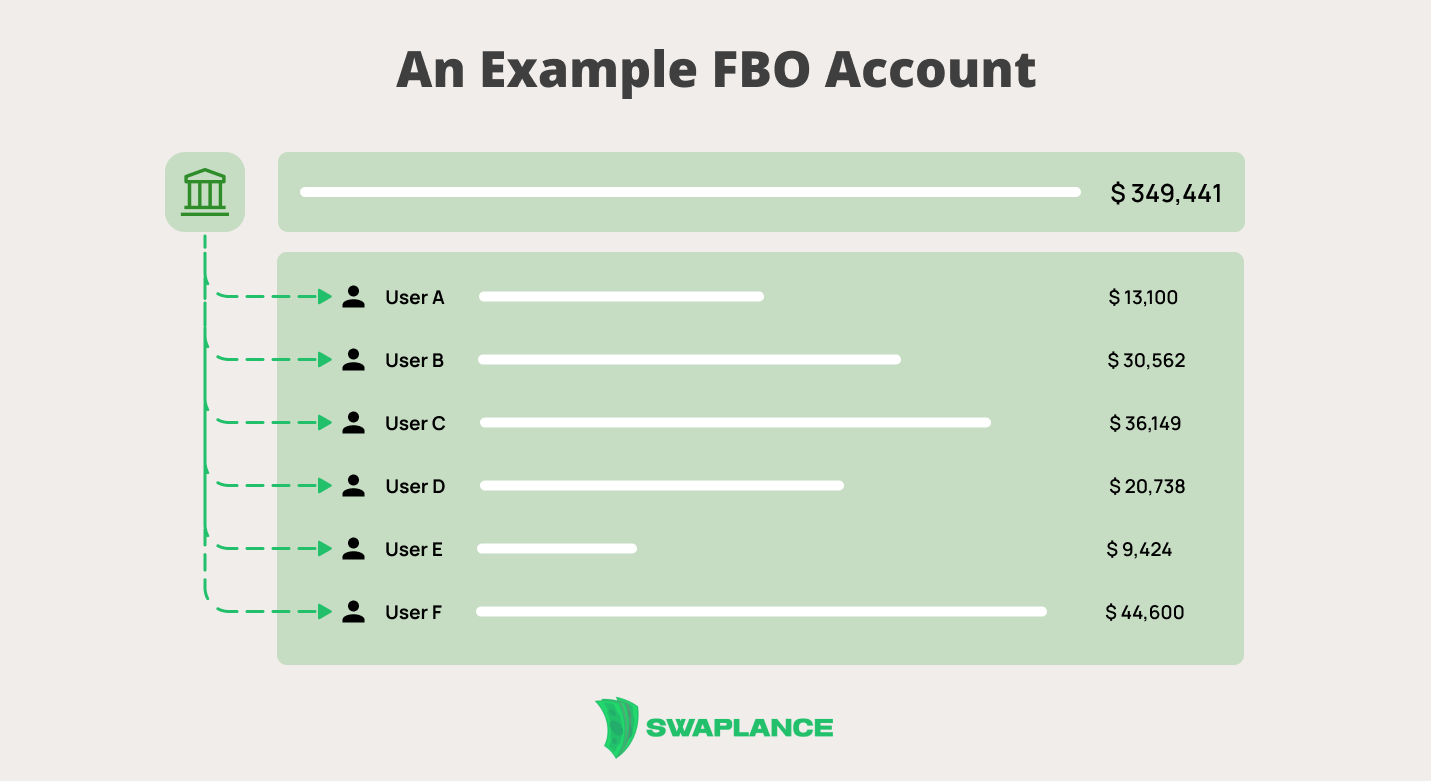

FBO accounts are critical components in modern banking, particularly within the fintech sector. In traditional banking, FBO accounts hold funds on behalf of multiple beneficiaries under a single master account. These accounts are commonly employed by payment processors, fintech companies, and other financial intermediaries to manage client funds securely and efficiently.

The main purpose of an FBO account in banking is to separate individual clients' funds from the operating funds of the account management company. This ensures that client funds are protected and can only be used for their intended purpose, thereby providing a layer of security and trust.

In fintech, FBO accounts are integral to the operations of platforms that manage large volumes of customer transactions. For instance, a payment processing company might hold all customer deposits in an FBO account at a bank, ensuring that each customer's funds are accurately tracked and protected, even though they are pooled in a single account.

The use of FBO accounts in banking is a practical solution for fund management and a regulatory requirement in many jurisdictions. It ensures compliance with financial laws and safeguards customer interests.

Importance of FBO Accounts in FinTech

FBO accounts play a pivotal role in the fintech ecosystem, enabling the secure and efficient management of customer funds. These accounts are essential for fintech companies that handle large volumes of transactions on behalf of their users. Using FBO accounts, fintech companies can keep client funds separate from their operational accounts, reducing the risk of mismanagement and ensuring regulatory compliance.

Their role in maintaining trust also highlights the importance of FBO accounts in fintech. Customers need assurance that their funds are protected, and FBO accounts provide this by offering a clear separation between client funds and company assets. This structure safeguards client money and simplifies the accounting and auditing processes, as each beneficiary's funds can be tracked accurately.

Furthermore, FBO accounts are vital for compliance with financial regulations. Many jurisdictions require fintech companies to maintain separate accounts for client funds to prevent misuse and protect consumers in case of insolvency. As such, FBO accounts are a practical solution and a regulatory necessity in the fintech industry.

How FBO Accounts Work

FBO (For the Benefit Of) accounts are specialized banking accounts used primarily in the fintech sector to manage funds for multiple beneficiaries. These accounts are essential for businesses that handle third-party funds, such as payment processors, digital wallets, or marketplace platforms.

- FBO on Bank Statement: When funds are held in an FBO account, the account title on a bank statement will typically include "FBO," indicating that the account is held for the benefit of specific clients or users. For example, a fintech company might hold an account labeled "XYZ Fintech FBO Customers," showing that the funds within the account are not owned by the company but by its customers.

- FBO Stands for Banking: In banking, FBO stands for "For the Benefit Of," which means the account holds funds on behalf of another party. The bank holds the funds in trust for the beneficiaries, ensuring that the company cannot use them for its operational expenses. This structure is crucial for maintaining trust and compliance with financial regulations.

- FBO Meaning in Business: In a business context, FBO accounts are used to segregate customer funds from the company’s operational accounts. This segregation is important for protecting client assets, ensuring transparency, and complying with regulatory requirements. By maintaining an FBO account, a company can manage funds for multiple clients while keeping these funds distinct and protected from potential business liabilities.

FBO accounts are critical tools in the fintech industry. They provide a secure and compliant way to manage client funds while maintaining transparency and trust. Platforms like Swaplance can be invaluable for businesses looking to integrate FBO accounts into their operations, offering access to freelance experts who can help navigate the complexities of setting up and managing these accounts.

Examples of FBO Accounts in Use

FBO (For the Benefit Of) accounts are widely used in the fintech industry to manage and segregate funds for multiple users or clients. Here are some examples of how these accounts are utilized:

- FBO Accounting in Payment Processing: Payment processors like PayPal or Stripe use FBO accounts to hold and manage funds on behalf of their users. When a user makes a payment, the funds are transferred to an FBO account specifically designated for that user. This allows the payment processor to manage and distribute the funds while ensuring that the money is kept separate from the company’s operating funds. This practice is a key aspect of FBO accounting, which ensures transparency and compliance with financial regulations.

- FBO Account in Fintech Platforms: Fintech companies offering services like digital wallets or peer-to-peer lending platforms like Montowire often utilize FBO accounts to handle customer funds. For instance, a digital wallet service may have an FBO account where all customer funds are deposited. The company holds these funds in trust, ensuring each customer's balance is accurately reflected in their account. This setup is crucial in fintech because it helps to protect customer funds and maintain trust in the platform.

- FBO Account Fintech in Crowdfunding Platforms: Crowdfunding platforms like Kickstarter or GoFundMe may use FBO accounts to manage the funds raised by campaigns. When contributors donate to a campaign, the funds are placed into an FBO account designated for that specific campaign. The platform holds these funds until the campaign reaches its goal or the funds are distributed according to its rules. This ensures that the money is managed responsibly and is only used for its intended purpose.

FBO accounts play a crucial role in the operation of fintech companies, ensuring that customer funds are protected, accurately accounted for and properly managed.

Benefits of FBO Accounts

FBO (For the Benefit Of) accounts offer several benefits, particularly in the fintech and financial services industries:

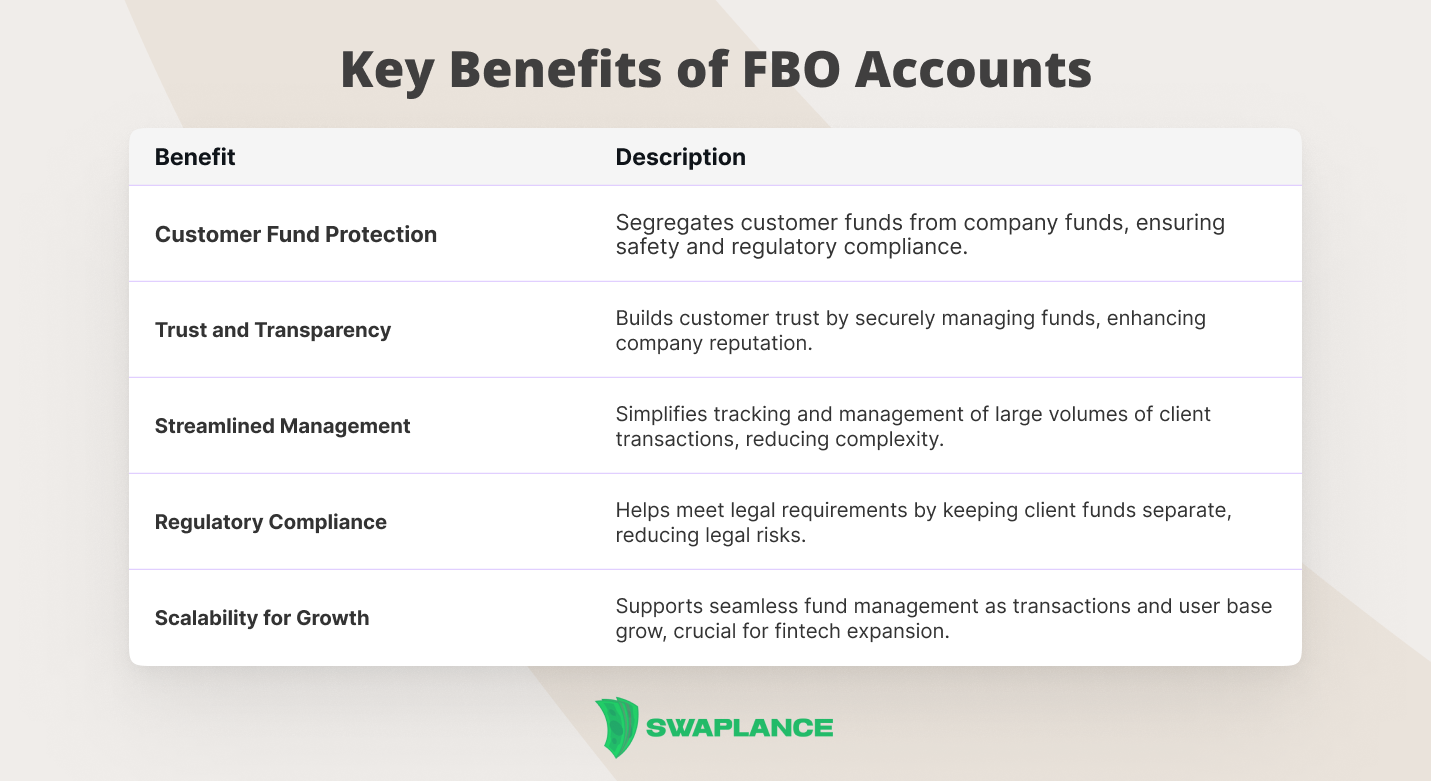

- Customer Fund Protection: FBO accounts ensure customer funds are segregated from a company’s operational funds. This separation provides a layer of protection, ensuring that customer assets are not at risk if the company faces financial difficulties. It also aids in compliance with financial regulations that require clear distinctions between client and company funds.

- Improved Trust and Transparency: Companies can increase customer trust by holding funds in an FBO account. Users are assured that their money is managed securely and transparently. The use of FBO accounts can enhance a company’s reputation, as customers can clearly see that their funds are being handled responsibly and regulated.

- Streamlined Financial Management: FBO accounts simplify financial management for companies handling large volumes of client transactions. These accounts allow for more organized and efficient tracking of funds, reducing the complexity of managing multiple accounts or payment streams. This can lead to improved financial oversight and reduced administrative burdens.

- Compliance with Regulations: Many financial regulations require businesses to keep client funds separate from their own. FBO accounts help companies meet these regulatory requirements, reducing legal risks and ensuring compliance with financial industry standards.

- Scalability for Fintech Platforms: FBO accounts are critical for scaling operations for fintech companies. As the business grows and the number of transactions increases, FBO accounts allow for the seamless management of funds across a large user base. This scalability is essential for fintech platforms that aim to expand rapidly while maintaining robust financial controls.

Overall, FBO accounts provide a secure, transparent, and efficient way for companies to manage client funds, contributing to better financial management and enhanced customer trust.

Challenges and Risks of FBO Accounts

FBO (For the Benefit Of) accounts offer significant advantages, but they also come with challenges and risks that businesses need to consider:

- Regulatory Complexity: Managing FBO accounts requires compliance with various regulations, which can vary by jurisdiction. Ensuring that the segregation of client funds is maintained following all applicable laws can be complex, especially for businesses operating in multiple regions. Failure to comply with these regulations can result in legal penalties and loss of customer trust.

- Operational Risks: The administration of FBO accounts demands strict financial controls and oversight. If these controls are inadequate, there is a risk of operational errors, such as misallocating funds or accounting discrepancies. These issues can lead to financial losses, legal challenges, and reputational damage.

- Security Concerns: Due to the large amount of funds they often hold, FBO accounts are attractive targets for fraud and cyberattacks. Businesses must invest heavily in security measures to protect these accounts from unauthorized access and theft. Any breach can have severe consequences, including financial loss and a loss of customer confidence.

- Liquidity Management: Businesses managing FBO accounts must ensure that they have adequate liquidity to cover withdrawals and transactions on behalf of their clients. Poor liquidity management can lead to delays in fund transfers, impact customer satisfaction, and potentially cause financial instability for the business.

- Legal Liability: Although FBO accounts separate client funds from a company’s operating funds, the company remains legally responsible for properly managing these funds. In a financial dispute or legal action, the company could be held liable for any mismanagement or failure to safeguard client assets.

- Customer Trust and Expectations: While FBO accounts are designed to protect customer funds, any perceived mismanagement or lack of transparency can erode customer trust. Businesses must communicate clearly with clients about managing their funds and consistently meeting customer expectations.

Overall, while FBO accounts provide essential benefits for managing client funds, they require careful management to mitigate these challenges and risks.

Future Trends for FBO Accounts

The future of FBO accounts looks promising, particularly as the fintech sector continues to grow and evolve. As more businesses move towards digital and platform-based models, the need for secure and transparent fund management will increase, driving the adoption of FBO account structures. Additionally, advancements in technology, such as blockchain and smart contracts, could further enhance the security and efficiency of FBO accounts, making them an even more integral part of the financial landscape. The growth of FBO accounts will likely continue as they become a cornerstone of trust and transparency in the modern financial ecosystem.

Common questions

-

How does an FBO account differ from traditional banking accounts?An FBO account differs primarily from traditional banking accounts in structure and purpose. Unlike standard bank accounts, which are owned and operated directly by the account holder, an FBO account is held by a company or financial institution on behalf of its clients. The funds in an FBO account are technically owned by the clients, not the company managing the account, ensuring segregation of client funds from the company's operational funds. This setup is commonly used in fintech and payment platforms to manage and disburse client funds while maintaining regulatory compliance securely.

-

What role do FBO accounts play in fintech platforms?FBO accounts play a crucial role in fintech platforms by securely managing and segregating client funds. These accounts are used to hold funds on behalf of users, ensuring that the money is separated from the platform’s operational funds, which is essential for compliance with financial regulations. This structure allows fintech companies to handle transactions, such as payments and disbursements, more efficiently and transparently, providing users with trust and security in the platform's financial operations.

-

How are FBO accounts regulated in the financial industry?FBO accounts are regulated within the financial industry through various frameworks that ensure compliance with banking laws and financial regulations. These accounts must adhere to anti-money laundering (AML) and know-your-customer (KYC) regulations, requiring the fintech platforms managing them to verify users' identities and monitor transactions for suspicious activity. Additionally, FBO accounts are often subject to oversight by financial regulators such as the Federal Deposit Insurance Corporation (FDIC) in the U.S., ensuring that the funds are protected and managed correctly in case of insolvency of the fintech company.

Mark Petrenko

Mark Petrenko