What is Banking-as-a-Service? Your questions answered

Banking-as-a-Service (BaaS) is a rapidly growing sector within the financial industry, offering unprecedented opportunities for businesses to integrate banking services into their products and services. From startups to established enterprises, BaaS enables companies to provide financial services without owning a banking license or infrastructure. In this article, we’ll explore what BaaS is, how it works, its benefits and challenges, and the future trends shaping this innovative approach to banking.

Understanding Banking-as-a-Service (BaaS)

Banking-as-a-Service (BaaS) allows non-bank businesses to offer financial services by leveraging traditional banks' infrastructure and regulatory licenses. In essence, BaaS providers create a bridge between fintech companies, developers, and regulated financial institutions, enabling these companies to offer banking services such as accounts, payments, lending, and cards directly to their customers.

At its core, BaaS refers to a set of APIs and services provided by banks or licensed institutions, allowing third parties to build and integrate financial products into their platforms. This means that businesses, even those not traditionally in the financial sector, can offer their customers banking features without becoming a bank themselves.

The definition of Banking-as-a-Service can be broken down into two primary components:

- Infrastructure and Compliance: Banks provide the underlying banking infrastructure, including core banking systems, payment gateways, and regulatory compliance. This infrastructure is crucial because it ensures that the non-bank companies offering these services comply with the strict regulations governing the financial industry.

- APIs and Integrations: BaaS relies heavily on APIs (Application Programming Interfaces) that allow developers to connect with the bank’s services. Through these APIs, businesses can seamlessly integrate financial features like payment processing, digital wallets, and account management into their platforms.

In summary, BaaS democratizes access to financial services, enabling companies to offer banking products under their brand, enhancing customer experiences and creating new revenue streams.

How Does Banking-as-a-Service Work?

Banking-as-a-Service allows non-bank businesses, such as fintech companies, to offer banking services through APIs provided by licensed banks. Essentially, BaaS acts as a bridge between traditional banks and third-party providers, enabling these providers to integrate various banking functionalities into their products and services. BaaS enables companies to offer financial services without needing to become fully licensed banks themselves, significantly reducing the barrier to entry into the financial industry.

Integrating BaaS without a BaaS provider is extremely challenging and generally not feasible for most companies. As financial institutions offering banking services to third parties via a BaaS platform, Bank-as-a-Service providers provide their customers with the essential infrastructure, regulatory compliance, and banking licenses needed to offer financial services. Non-bank companies, in turn, can focus on creating innovative financial products and services that cater to their customers' needs.

BaaS platforms typically include several key components:

- API Gateway: The API gateway interfaces the bank’s core systems and the external companies using BaaS. This gateway facilitates the secure and efficient data exchange between the bank and the company’s applications.

- Core Banking Systems are the foundational systems that manage financial transactions, customer data, and account information. The BaaS provider allows external companies to access these systems via APIs.

- Compliance and Security: One of the critical functions of a BaaS provider is ensuring that all transactions and services comply with financial regulations and industry standards. This includes anti-money laundering (AML) checks, Know Your Customer (KYC) processes, and data protection.

- Customization and White-Labeling: BaaS providers often allow companies to customize the banking services to match their brand identity. This white-labeling approach means that end customers interact with the company’s brand, even though the BaaS provider provides the underlying banking services.

- Integration and Deployment: Once the APIs are integrated into the company’s platform, the BaaS provider supports deploying these services, ensuring they operate smoothly and securely.

Swapllance's freelance experts can help integrate BaaS into your existing platform, allowing your business to seamlessly incorporate financial services such as payments, account management, and lending.

Benefits and Applications of BaaS

Banking-as-a-Service offers numerous benefits for the companies that use these services and the end customers. BaaS's flexibility and efficiency have led to its adoption across various industries, enabling a new generation of financial products and services.

Some of the most prominent examples of Banking-as-a-Service, such as Chime neobank, Uber, or Shopify e-commerce platform, are integrating payment processing and digital wallets into e-commerce platforms. For instance, an online retailer might use BaaS to offer customers the ability to store funds, manage their spending, and even earn rewards, all within the retailer’s app.

Another example is fintech companies offering lending services. Square and Revolut can be cited as examples. By partnering with a BaaS provider, these fintech companies can provide payment processing and financial services to small businesses as well as offer cryptocurrency trading and budgeting tools without building the underlying banking infrastructure.

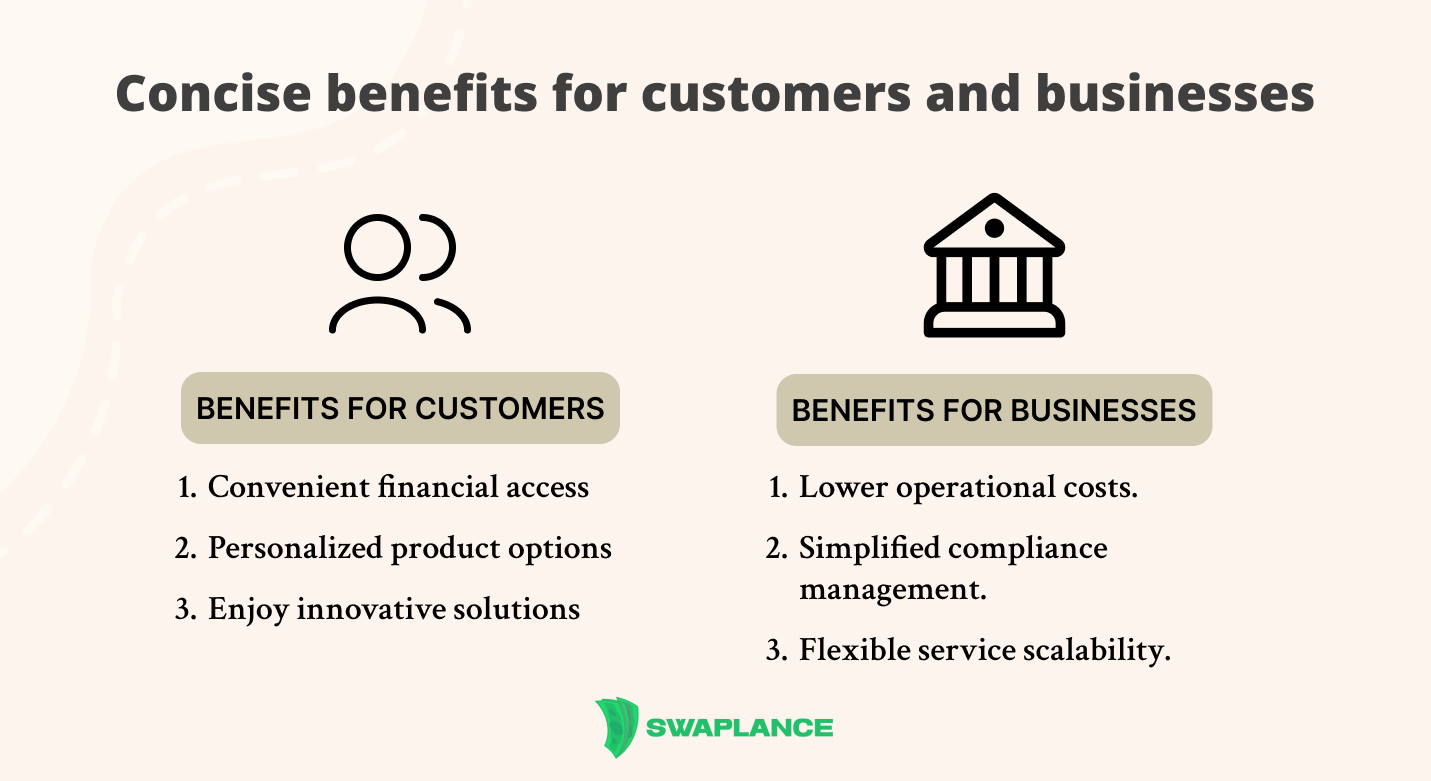

Benefits for Businesses

- Cost-Efficiency: One of the primary advantages of BaaS is the significant cost savings. Businesses do not need to invest in building and maintaining a banking infrastructure, which can be extremely expensive and complex. Instead, they can leverage the infrastructure of BaaS providers, reducing both time and financial investment.

- Regulatory Compliance: Navigating the regulatory landscape in the financial industry is challenging. BaaS providers handle compliance, ensuring all services meet legal and regulatory requirements. This allows companies to focus on their core business activities.

- Scalability and Flexibility: BaaS enables companies to scale their financial services quickly and efficiently. Whether a company is a small startup or a large enterprise, BaaS allows them to offer banking services that can grow with their customer base.

- Enhanced Customer Experience: Companies can offer a seamless and improved customer experience by integrating banking services into their platforms. For example, a travel app might use BaaS to provide users with a travel savings account or currency exchange services, all within the app.

Benefits for Customers

- Convenience: Customers benefit from having financial services embedded directly into their existing products. This convenience can lead to higher customer satisfaction and loyalty.

- Personalization: BaaS allows companies to offer personalized financial products catering to their customers' needs. For example, a ride-sharing app might offer drivers tailored savings accounts or instant payment options.

- Innovative Financial Products: BaaS has led to the creation of new and innovative financial products that offer more options and better value for customers. These products can include everything from mobile banking to digital wallets and beyond.

Challenges and Considerations in BaaS Adoption

While Banking-as-a-Service offers many benefits, it also comes with its own set of challenges and considerations. Companies looking to adopt BaaS must be aware of these potential obstacles to ensure a successful implementation.

One of the most significant challenges in adopting BaaS is ensuring regulatory compliance. Financial services are subject to strict regulations, and companies using BaaS must ensure their services comply with all relevant laws and standards, including AML, KYC, and data protection regulations.

Security is a top priority in financial services. BaaS providers must implement robust security measures to protect customer data and prevent fraud. Companies must also ensure their integration with the BaaS platform does not introduce vulnerabilities.

When using BaaS, companies rely on their BaaS provider for their financial services' availability, security, and compliance. This dependence can be risky if the provider experiences downtime or fails to meet regulatory requirements.

Integrating BaaS into a company’s existing systems can be complex and time-consuming. Companies must ensure that their technical teams are equipped to handle the integration and that the BaaS provider offers adequate support.

Customers need to trust that the financial services offered by non-bank companies are safe and reliable. Building this trust can be challenging, especially if the company is new to the financial industry. Transparent communication and strong customer support are essential to overcoming this challenge.

Future Trends in BaaS

As the financial industry evolves, Banking-as-a-Service is expected to play an increasingly important role. Several trends will likely shape the future of BaaS, offering new opportunities and challenges for businesses and customers.

Embedded finance is the integration of financial services into non-financial products. BaaS is a key enabler of this trend, allowing companies in various industries to offer banking services directly within their products. This trend is expected to grow, with more companies looking to offer financial services to enhance customer experiences.

As BaaS continues to evolve, providers are likely to expand their BaaS offerings to include a broader range of financial services. These could include insurance products and wealth management services, providing companies with even more innovative opportunities.

The popularity of BaaS has led to increased competition among BaaS providers. This competition is expected to drive innovation, leading to better services and lower costs for companies using BaaS. It may also result in more specialized BaaS providers that cater to specific industries or use cases and are moving towards offering highly personalized financial services tailored to individual customer needs. Using data analytics and AI, companies can create custom financial products, such as savings plans, investment opportunities, and loan offers, based on a customer’s unique financial situation and behavior.

As BaaS becomes more widespread, regulators are likely to introduce new standards and regulations to ensure the safety and stability of these services. This could include standardized APIs, stricter data protection requirements, and more rigorous oversight of BaaS providers.

The future of BaaS is likely to see even greater collaboration between traditional banks and fintech companies. Banks once seen as competitors to fintech firms are increasingly partnering with these companies to offer BaaS solutions. This collaboration allows banks to leverage fintech's innovative capabilities while fintech gains access to established banks' regulated infrastructure.

Banking-as-a-Service is revolutionizing the financial industry by enabling non-bank companies to offer their customers a wide range of banking services. By leveraging the infrastructure, compliance, and APIs BaaS providers provide, businesses can create innovative financial products without the complexities of becoming a bank.

While BaaS offers numerous benefits, such as cost efficiency, scalability, and enhanced customer experiences, it also comes with challenges, including regulatory compliance and security concerns. However, as BaaS continues to evolve and more businesses adopt this model, we can expect to see even more exciting developments and innovations in finance.

Common questions

-

What types of companies can benefit from Banking-as-a-Service?BaaS is particularly beneficial for various companies across different sectors. Fintech startups can use BaaS to offer banking services such as payments, lending, and savings accounts without needing a banking license. E-commerce platforms can also benefit by directly integrating payment and financing options into their services, enhancing customer convenience. Additionally, non-financial companies, such as retailers or telecom providers, can leverage BaaS to offer branded financial products like loyalty programs or credit cards, creating new revenue streams and enhancing customer loyalty.

-

How does Banking-as-a-Service (BaaS) differ from traditional banking?BaaS allows non-bank companies to offer banking services without becoming fully licensed banks. Through BaaS, these companies can integrate financial services like payments, lending, or account management directly into their platforms using APIs provided by licensed banks. This contrasts with traditional banking, where banks directly control all aspects of their financial products. BaaS enables a more flexible, scalable, and tech-driven approach, often resulting in more innovative and customer-centric financial solutions.

-

What are some real-world examples of Banking-as-a-Service (BaaS)?Real-world examples of Banking-as-a-Service include companies like Chime and Revolut, which offer banking services such as checking accounts and debit cards through partnerships with licensed banks. Square uses BaaS to provide small businesses with payment processing and business banking solutions. Additionally, Uber has integrated financial services for its drivers, like instant payouts and debit cards, using BaaS platforms. These examples show how BaaS enables non-bank companies to offer financial products tailored to their specific customer base.

Mark Petrenko

Mark Petrenko