Wire Transfer Fees: Full Guide

A Wire Transfer is a method of electronically transferring money between different banks or financial institutions. It involves moving the money from one bank account to another, either domestically or internationally.

The term Wire comes from the days when such transfers were actually made over telegraph cables – wires. Today, wire transfers are usually done electronically through the SWIFT network or other financial systems.

Wire transfers are often a fast and secure way to transfer large amounts of money, but they can also come with fees, especially for international transactions.

The time it takes to complete a wire transfer can vary depending on several factors. In general, wire transfers within the same country can often be completed within a day, while international transfers can take several days or even longer, depending on the countries involved and the respective bank policies.

The cost of a wire transfer varies depending on the bank, the destination country, and the amount being transferred. Often, fees range from three to five percent of the total amount involved.

What is a Wire Transfer?

We can define a wire transfer as an electronic method of transferring money from one bank account to another, either within the same country or across international borders. Wire transfers are often used for high-value transactions or when speed is essential, as they can be processed within a few hours to a day, depending on the banks involved and the destination of the transfer. Unlike other forms of money transfers, such as checks or Automated Clearing House (ACH) transfers, wire transfers are processed individually, making them more secure and reliable.

The sender typically initiates wire transfers through their bank, which then communicates with the recipient's bank to complete the transaction. This process can involve multiple banks, especially in international transfers, where intermediary banks may be used to facilitate the transfer. The security and speed of wire transfers make them a popular choice for both personal and business transactions despite the associated costs.

Types of Wire Transfer Fees

Wire transfer charges vary depending on several factors, including the type of transfer, the banks involved, and the destination of the funds. Here are some common types of wire transfer fees:

- Outgoing Wire Transfer Fee: The sending bank charges this fee to process the transfer. The fee can vary widely depending on whether the transfer is domestic or international.

- Incoming Wire Transfer Fee: Some banks charge a fee to receive wire transfers. This incoming fee is typically lower than the outgoing fee but can still add up, especially if you receive wires frequently.

- Intermediary Bank Fees: In international wire transfers, intermediary banks may charge fees to facilitate transfers. These fees are typically deducted from the transfer amount, so the recipient may receive less than expected. So when sending money through a bank, it's essential to understand if there is a wire transfer fee to ensure you're aware of any potential charges associated with the transaction.

- Foreign Exchange Fees: Banks may charge a foreign exchange fee if a wire transfer involves converting currencies. This fee can be a flat rate or a percentage of the transfer amount.

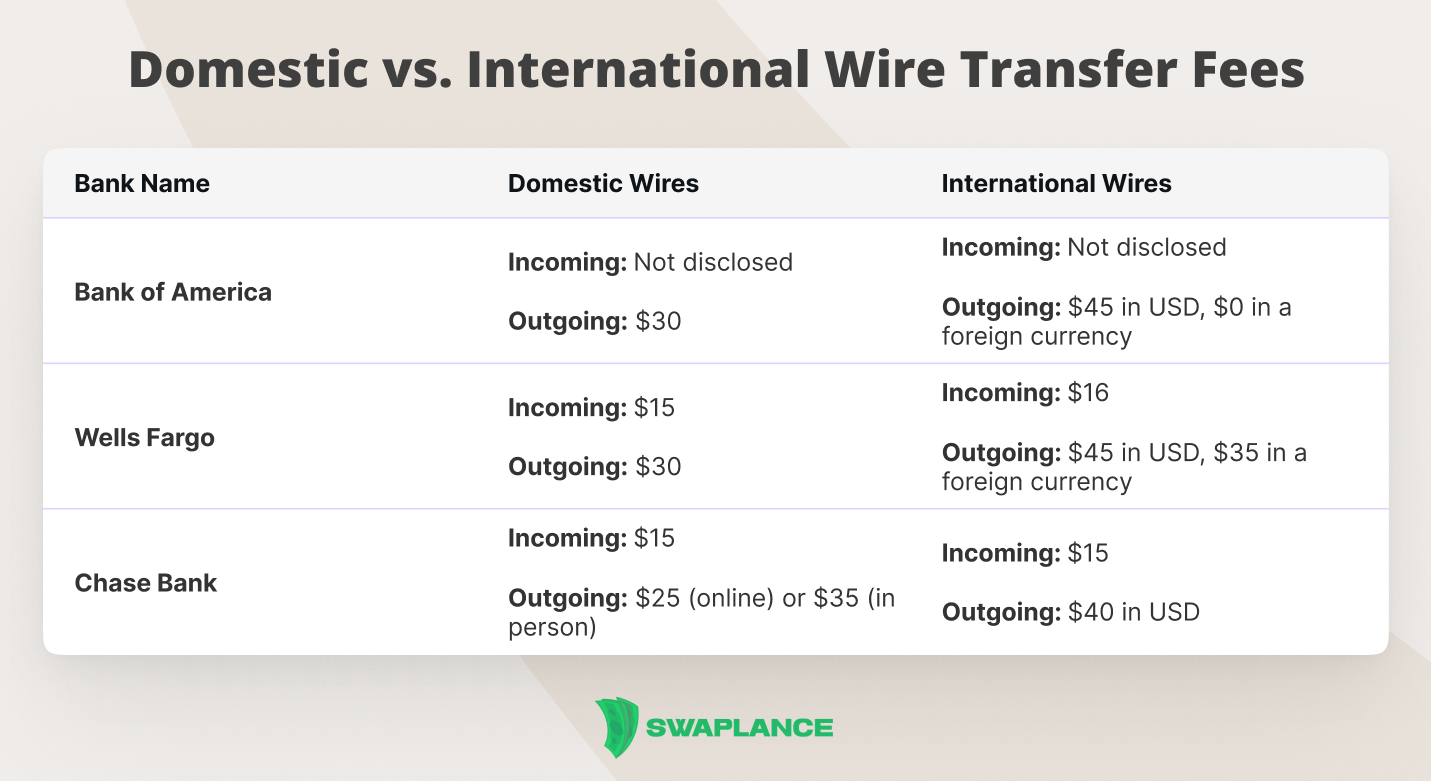

Domestic vs. International Wire Transfer Fees

Wire transfer fees differ significantly between domestic and international transactions.

- Domestic Wire Transfer Fees: Some banks charge a domestic incoming wire fee when receiving a wire transfer from another bank within the same country. These are generally lower than international fees and are typically charged flat rates. Domestic transfers are quicker and involve fewer intermediary banks, which reduces costs. Some banks may offer reduced fees or waive them altogether for certain account holders.

- International Wire Transfer Fees: These fees are usually higher due to the involvement of multiple banks and the need for currency conversion. International wire transfer charges can include the sending bank's fee, intermediary bank fees, and foreign exchange fees. These costs can add up, making international transfers more expensive than domestic ones.

How Much Do Wire Transfers Cost?

The cost of wire transfers can vary depending on several factors, including the type of transfer, the banks involved, and whether the transfer is domestic or international. These costs can include fees charged by the sending bank, receiving bank, and any intermediary banks involved in the transfer process.

In addition to these fees, some banks may also charge an additional fee if the transfer is done in person or over the phone, as opposed to online.

On average:

- Domestic Wire Transfers: Fees typically range from $15 to $30 per transfer. Some banks may offer lower fees or waive them for premium account holders.

- International Wire Transfers: Fees can range from $35 to $50 or more, depending on the destination and the banks involved. In addition to the sending fee, there may be intermediary bank fees and currency conversion charges.

The total cost of a wire transfer can also depend on the amount being transferred, with some banks charging a percentage of the total amount rather than a flat fee. It's important to check with your bank for a detailed breakdown of costs, if there are fees for wire transfers as these can add up, especially for frequent transfers.

Banks That Offer Free Wire Transfers

While most banks charge for wire transfers, some banks and credit unions offer free wire transfers as a benefit to their customers. Here are a few examples of which banks offer free wire transfers:

- Charles Schwab Bank, for instance, provides unlimited free domestic and international wire transfers for its Schwab Bank High Yield Investor Checking account holders.

- Fidelity offers free domestic wires for its Cash Management Account customers.

- USAA provides free domestic wire transfers for its USAA Classic Checking account holders.

- Additionally, Ally Bank offers free domestic outgoing wires for Interest Checking Account holders who maintain a minimum daily balance of $25,000 or more.

Such wire transfer free banks often have specific conditions or account types that must be met to qualify for free wire transfers, so it's essential to review the terms of each account.

Tips to Reduce Wire Transfer Fees

Here are some strategies of how to reduce wire transfer fees or even avoid them:

- Use Online Banks: As mentioned earlier, some online banks offer free wire transfers. If you frequently send wires, consider opening an account with an online bank that offers this perk.

- Join a Credit Union: Credit unions often have lower fees than traditional banks, and some offer free wire transfers to their members. This can be a cost-effective option if you're eligible to join a credit union.

- Opt for Alternative Transfer Methods: Depending on the situation, you can use a cheaper transfer method, such as ACH transfers, which are often free or low-cost. However, ACH transfers take longer to process than wire transfers.

- Plan Transfers Ahead of Time: If possible, avoid last-minute wire transfers, which can incur higher fees. By planning ahead, you can explore other transfer options that may be more cost-effective.

Alternatives to Wire Transfers

While wire transfers are fast and secure, they are only sometimes the most cost-effective option. Here are some other alternative methods to send money:

- ACH Transfers: ACH transfers are a low-cost alternative to wire transfers, especially for domestic transactions. While they take longer to process (usually 2-3 business days), they are often free or have a minimal fee.

- Peer-to-Peer Payment Apps: Apps like PayPal, Venmo, and Zelle allow you to transfer money quickly and easily. These apps are best suited for smaller amounts and are often free to use.

- Money Transfer Services: Services like Western Union and MoneyGram allow you to send money internationally, often at a lower cost than wire transfers. However, these services may have lower limits on the amount you can send.

- Cryptocurrency Transfers: For tech-savvy users, cryptocurrencies like Bitcoin offer a way to transfer money internationally with lower fees. However, cryptocurrency transfers come with their risks, such as price volatility and security concerns.

Whether you want to send or receive funds but do not know which method is more suitable, Swaplansce wire transfer experts are always ready to help.

Conclusion

Wire transfers are a reliable and secure method for transferring money, especially for large amounts or urgent transactions. However, free money wiring often depends on the bank or financial institution, and it comes with fees that can add up, especially for international transfers. By understanding the types of fees involved and exploring alternatives, you can reduce the cost of sending and receiving wire transfers. A wire transfer costs overview typically includes fees for sending and receiving funds, with domestic transfers generally being less expensive than international ones. Understanding these costs can help you choose the most cost-effective method for transferring money.

Common questions

-

Do all banks charge fees for wire transfers?Not all banks charge fees for wire transfers, but many do. The fees can vary widely depending on the type of transfer (domestic or international), the bank's policies, and the customer's account type. Some banks offer free wire transfers as part of premium accounts or specific services, while others may waive fees for certain customers, such as those with high account balances or frequent transfers. However, it's common for banks to charge fees ranging from $15 to $50 per transfer, especially for international transactions. Always check with your bank for their specific fee structure.

-

Which banks offer free wire transfers, and under what conditions?Some banks offer free wire transfers under certain conditions, typically tied to specific types of accounts or customer statuses. For example, Charles Schwab offers free domestic wire transfers for customers with a Schwab Bank High Yield Investor Checking account. Fidelity also provides free domestic wire transfers for account holders. Citibank waives wire transfer fees for clients who hold a Citi Priority, Citigold, or Citigold Private Client account. In many cases, premium or high-balance accounts qualify for fee waivers, but it's important to check your bank's specific terms and conditions to confirm eligibility.

-

Are there alternative ways to transfer money internationally without paying high fees?Yes, alternative ways exist to transfer money internationally without paying high fees. Services like Wise (formerly TransferWise) offer lower fees by using the mid-market exchange rate and charging a transparent fee based on the amount transferred. Revolut and PayPal are also popular options that provide competitive exchange rates and lower fees compared to traditional bank wire transfers, especially for smaller amounts. Additionally, cryptocurrency transfers through platforms like Coinbase can be a cost-effective alternative, particularly for cross-border payments, although they may involve currency conversion and transaction fees depending on the platform used.

Mark Petrenko

Mark Petrenko