What is the Stripe Payments System and How Does it Work? Everything You Need to Know

The world of digital payments has evolved rapidly, and one of the most prominent players in this space is Stripe. Businesses of all sizes, from startups to large enterprises, rely on Stripe's robust infrastructure for processing payments, managing subscriptions, and even banking services.

The Stripe Payments System is a financial infrastructure platform designed to help businesses accept and manage online payments. Founded in 2010, Stripe provides a wide array of payment processing solutions that support credit card payments, bank transfers, and digital wallets like Apple Pay and Google Pay. It is widely known for its developer-friendly API, allowing businesses to easily integrate payment functionality into websites, mobile apps, and other online platforms.

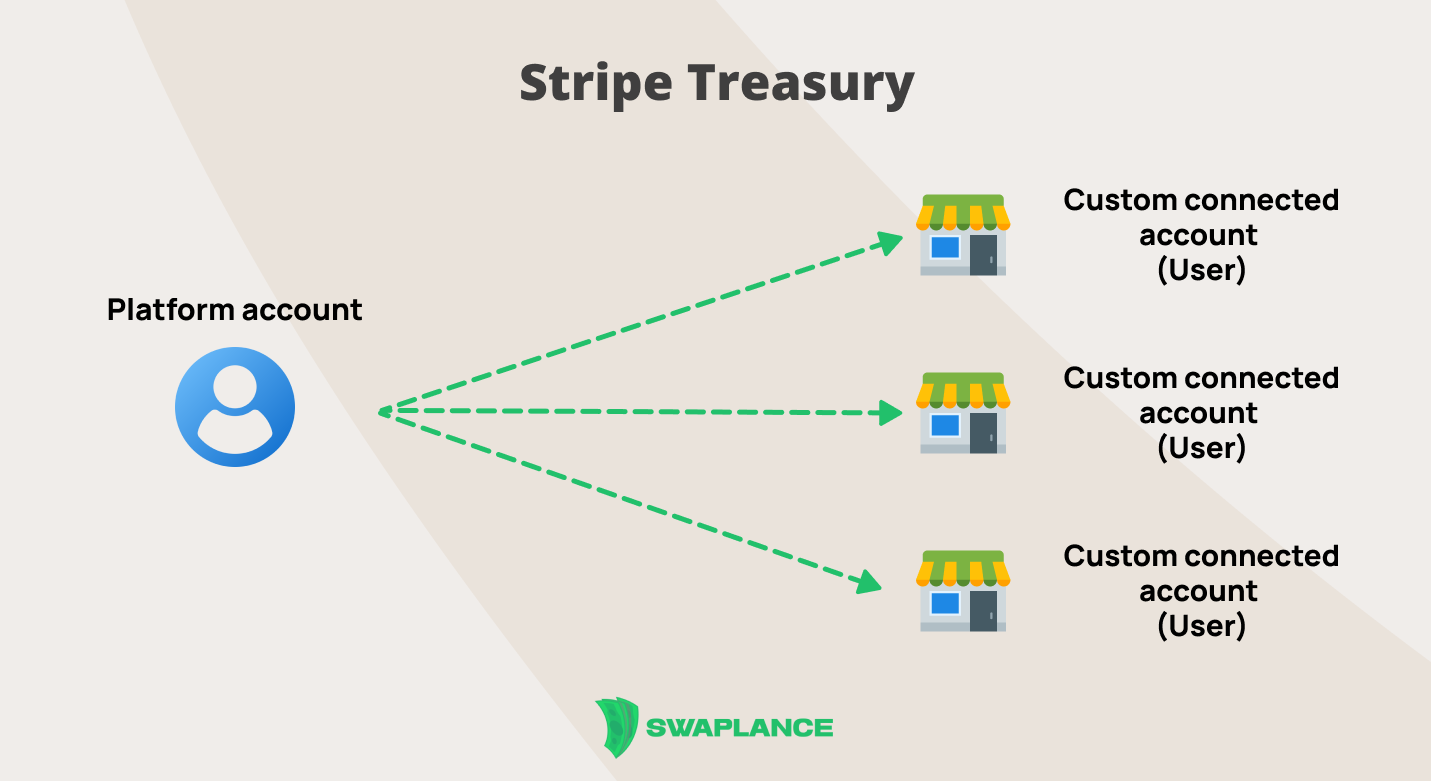

One of Stripe's key offerings is Stripe Treasury, which provides banking-as-a-service features. This enables businesses to embed financial services directly into their platforms, manage cash flows, and automate payouts. Stripe focuses on simplifying the payment process, enabling companies of all sizes to build and scale their payment systems efficiently.

Stripe supports global payments and offers tools for recurring billing, invoicing, and fraud detection, making it a versatile option for online commerce across a wide range of industries.

This article provides an in-depth look at what Stripe offers, its core functionalities, and how it works.

What is the Stripe Payments System?

The Stripe Payments System is a comprehensive financial infrastructure that allows businesses to accept payments, both online and in-person. Established in 2010, Stripe has become a leading platform for processing payments. It provides powerful tools for managing online transactions and supports various payment methods, such as credit cards, bank transfers, and wallets like Apple Pay and Google Pay.

One of Stripe's key offerings is Stripe Treasury, a financial infrastructure tool that enables businesses to create and manage cash flow systems. Stripe Treasury allows companies to embed financial services directly into their platform, helping businesses manage their money, automate payouts, and handle financial operations seamlessly.

Stripe offers global payment processing, subscription management, invoicing, and fraud prevention on a single platform. It is designed to be flexible enough for developers to customize their payment flows, making it ideal for businesses in a wide range of industries.

How Does Stripe Work?

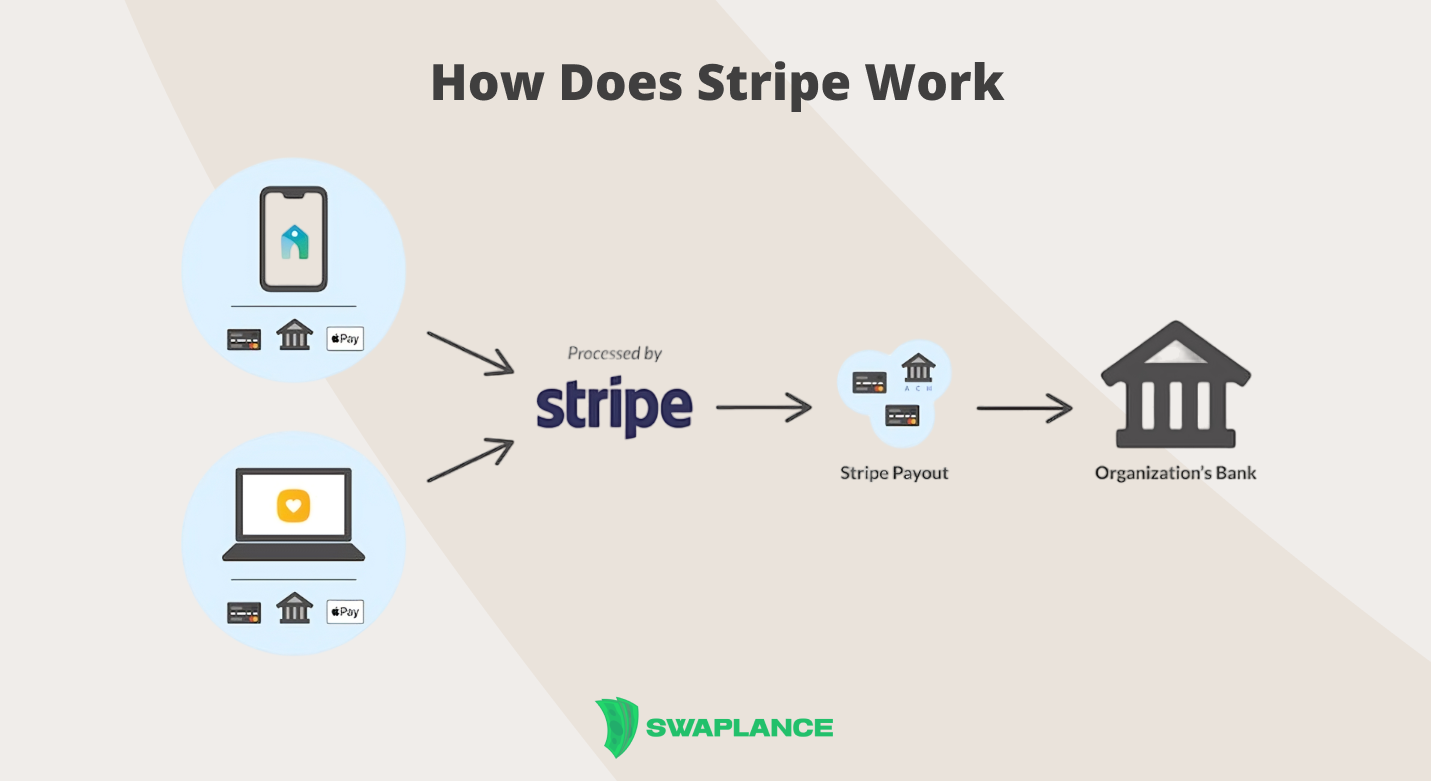

Stripe operates by offering a wide range of financial services through its payment processing platform, making it easier for businesses to accept and manage transactions online. At its core, Stripe integrates directly with e-commerce platforms, applications, and websites to handle payments securely, providing real-time authorization, payment processing, and transaction settlement.

One of the essential components of its services is Stripe Banking-as-a-Service (BaaS). With Stripe BaaS, companies can integrate banking features directly into their platforms. For instance, businesses can offer services like issuing virtual bank accounts, handling ACH payments, and managing treasury services, all without needing a banking license. By partnering with financial institutions, Stripe provides seamless banking functionalities to users while taking care of compliance and infrastructure needs.

For example, companies can use Stripe to accept payments in different forms, including credit and debit cards, direct bank transfers, and other local payment methods. Stripe takes care of the payment flow, from customer checkout to fund disbursement, while also providing tools for fraud prevention and tax management, ensuring a smooth payment experience.

Through its banking-as-a-service features, Stripe allows businesses to operate as financial entities, offering services that enhance cash management, payouts, and overall financial workflows.

Key Features of the Stripe Payments System

The Stripe Payments System offers a range of powerful tools and services designed to simplify online payment processing and provide a comprehensive financial infrastructure for businesses. Some of the V3S 8N4 of the Stripe platform include:

- Global Payment Acceptance: Stripe supports a wide array of payment methods, including credit and debit cards, ACH, wire transfers, and local payment options. This makes it easy for businesses to accept customer payments worldwide in multiple currencies.

- Stripe Opal: As a core part of Stripe's technology stack, Stripe Opal is an internal framework that ensures high availability and fault tolerance in handling large-scale transaction volumes. It enhances the platform's reliability, enabling businesses to process millions of payments securely and without disruption.

- Fraud Prevention Tools: Stripe incorporates advanced fraud detection systems through Stripe Radar, which uses machine learning models to help businesses identify and mitigate fraudulent transactions in real-time.

- Customizable Checkout: Businesses can fully customize their checkout experience using Stripe's pre-built or customizable API integrations, allowing for a seamless and branded customer payment experience across platforms.

- Subscription and Billing Management: Stripe makes it easy to manage recurring billing, including handling subscriptions, invoicing, and automatic payment collection. This is especially valuable for businesses with subscription-based models.

- Advanced Reporting and Analytics: Stripe provides detailed financial reporting and analytics, helping businesses track revenue, payment flows, and customer trends.

- Payout and Treasury Services: Stripe facilitates smooth payouts to merchants and provides Stripe Treasury, which allows businesses to manage cash flows and offer financial services such as holding funds, making payments, and managing treasury operations without needing to integrate with traditional banks directly.

These key features make Stripe an attractive option for businesses looking to manage their payments and financial infrastructure efficiently. Swaplans freelancer experts will help you integrate exactly the functions that your business needs.

What Bank Does Stripe Use?

While Stripe itself is not a bank, it partners with various banking institutions to provide its financial services. Stripe works with banks worldwide to process payments and manage funds. In the U.S., one of the primary banking partners is Silicon Valley Bank (SVB), but Stripe also works with Goldman Sachs for broader financial infrastructure.

Globally, Stripe collaborates with various banks to handle transactions in different currencies and regions. This allows the company to offer cross-border payment services and support a wide range of local currencies and payment methods.

If you're wondering what bank does Stripe use, the answer depends on the country and the financial service Stripe provides. In Europe, for example, Stripe works with different banking partners than in the U.S. By partnering with well-established and regulated banks like Barclays in the UK and Citibank or Santander across various European countries, Stripe ensures that businesses using its services are compliant with local financial regulations while providing seamless payment solutions for their customers.

Understanding Stripe Treasury and Its Pricing

Stripe Treasury is a financial product that enables businesses to offer banking-like services to their customers by integrating financial tools directly into their platforms. Through banking-as-a-service (BaaS), Stripe Treasury allows companies to hold funds, make payments, and manage cash flows without needing to work directly with traditional banks. This makes it easier for platforms, fintech companies, and marketplaces to provide a wide range of financial services, such as accounts, payments, and lending.

Stripe Treasury is powered by partnerships with regulated banks, allowing businesses to offer features like:

- Accounts: Businesses can offer accounts to their users, where funds can be stored securely.

- Payments: With Stripe Treasury, businesses can initiate payouts, manage cash transfers, and offer various payment options to their customers.

- Cash Flow Management: Businesses can track their cash positions, automate payments, and ensure they have real-time visibility into their finances.

The pricing for Stripe Treasury is highly dependent on the services a business chooses to implement, its transaction volume, and custom usage. Stripe operates on a transaction-based pricing model for most of its services, including its payments platform. Stripe Treasury generally has a mix of flat-rate fees and transaction fees, but the exact pricing can vary based on the complexity of the services requested.

While Stripe offers transparent pricing for its payment gateway, specific Stripe Treasury pricing typically requires a tailored plan based on the company’s needs. Stripe encourages businesses to contact them directly for detailed information on customized pricing plans that fit their particular financial service use cases.

Stripe Treasury empowers companies to integrate financial services and create better user experiences. Its flexible pricing model supports a wide range of business models.

Common questions

-

What is Stripe Banking-as-a-Service (BaaS)?Stripe Banking-as-a-Service (BaaS) enables businesses to integrate banking and financial services directly into their platforms using Stripe’s APIs. This service allows businesses to offer features like bank accounts, payments, and card issuance to their users without needing to establish a full banking infrastructure. Stripe partners with financial institutions like Barclays and Citibank to provide these services, making it easier for businesses to manage and automate their cash flows, handle payments, and offer advanced financial tools to their customers. This embedded financial solution allows companies to expand their financial services offerings while remaining compliant with regulatory standards.

-

How does Stripe Treasury work?Stripe Treasury provides businesses with the infrastructure to manage their financial operations through APIs. It allows companies to create and manage bank accounts, move funds, and automate cash management processes seamlessly within their platforms. Through partnerships with established banks like Goldman Sachs and Citibank, Stripe Treasury offers services like interest-earning accounts, faster payments, and reconciliation tools. The solution is designed to integrate into various business workflows, enabling companies to offer their customers financial products, such as holding funds and making payments, without becoming a bank themselves.

-

What banks partner with Stripe for its services?Stripe partners with several prominent US and European banks to provide its financial infrastructure. In the United States, Stripe collaborates with Goldman Sachs and Citibank to offer services like embedded banking, account management, and faster payment solutions. In Europe, Stripe partners with Barclays and Santander to facilitate similar offerings, enabling businesses to access banking-as-a-service (BaaS) and treasury solutions. These partnerships allow Stripe to deliver financial services to businesses without them having to become fully regulated financial institutions.

Mark Petrenko

Mark Petrenko