10 Fintech Trends for 2025 That Define the Industry's Future

The fintech industry is evolving at a rapid pace, with advancements in technology driving new ways for consumers and businesses to manage their finances. As we approach 2025, several trends are set to reshape how people interact with financial services. From the rise of AI to innovations in digital payments, these fintech trends will help define the industry's future.

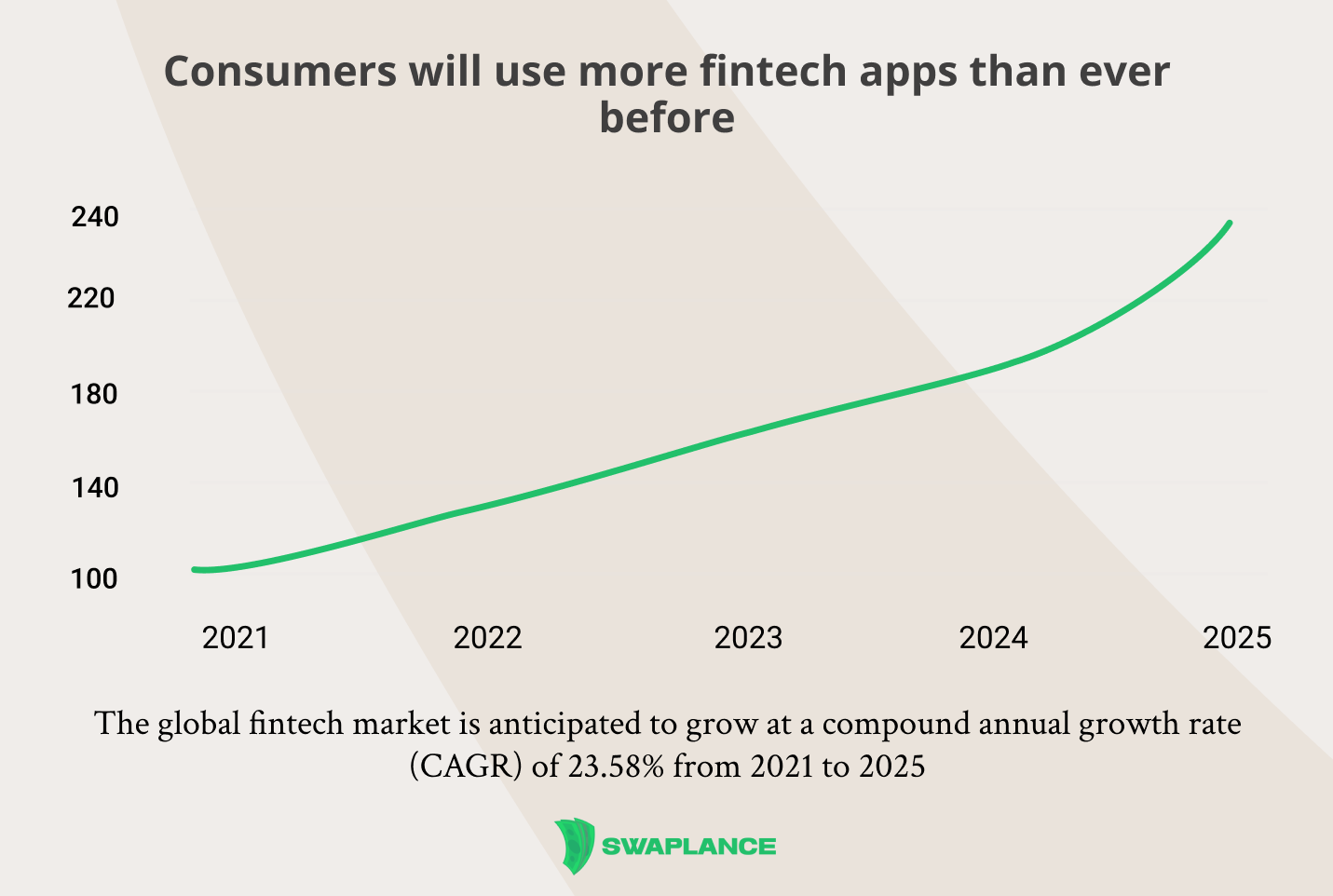

1. Consumers Will Use More Fintech Apps Than Ever Before

As technology becomes an even larger part of daily life, consumers are expected to use a variety of fintech apps to manage their finances. From budgeting tools and investing platforms to peer-to-peer payment solutions, fintech trends indicate a shift toward more personalized, accessible, and user-friendly financial services. People now expect convenience and transparency in managing their money, and fintech apps provide exactly that. With platforms like Swaplance, businesses can connect with freelance experts who specialize in creating customized fintech applications that cater to this growing demand.

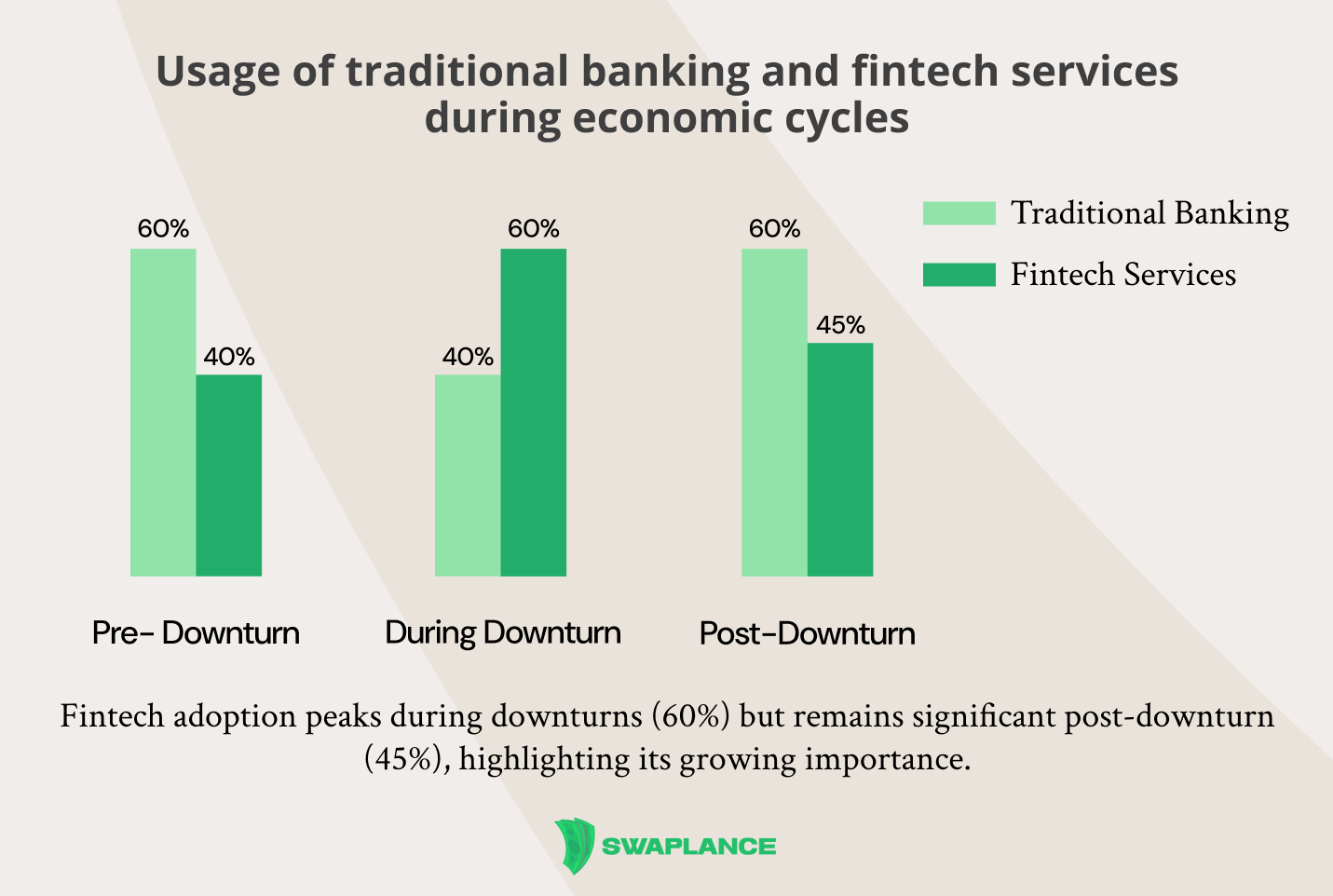

2. Fintech Increasingly Provides Financial Stability During Uncertain Times

Economic uncertainties, such as inflation and fluctuating markets, have fueled the demand for fintech solutions that offer greater financial stability. Many fintech companies are developing tools that provide consumers with personalized financial advice, budgeting assistance, and investment guidance. These financial trends reflect a shift toward making financial services accessible and supportive, even during tough times. For instance, digital banks and robo-advisors have grown in popularity because they help users navigate economic instability with low fees and accessible resources.

3. Emerging Payment Technologies Will Become as Normalized as Credit Cards

In recent years, digital wallets and contactless payments have become increasingly popular. By 2025, emerging payment technologies, such as cryptocurrencies, biometrics, and QR code payments, are expected to be as widely used as credit cards. These payments industry trends signal a transformation in how people pay for goods and services, emphasizing speed and convenience. Fintech companies are pioneering payment systems that don’t rely on traditional banking infrastructure, making transactions faster and easier. Swaplance connects businesses with freelance professionals who specialize in implementing these innovative payment solutions, allowing companies to stay competitive in this evolving landscape.

4. Credit Score Alternatives Will Revolutionize Consumer Credit

Traditional credit scoring methods are becoming outdated as fintech innovations continue to reshape consumer finance. New scoring models, which take into account factors like cash flow, spending behavior, and even social media activity, are set to disrupt the industry. By offering more inclusive alternatives to traditional credit scores, fintech companies can help underserved consumers gain access to credit. These fintech innovations are particularly beneficial for those without a long credit history, allowing more people to build a financial foundation and participate in the economy.

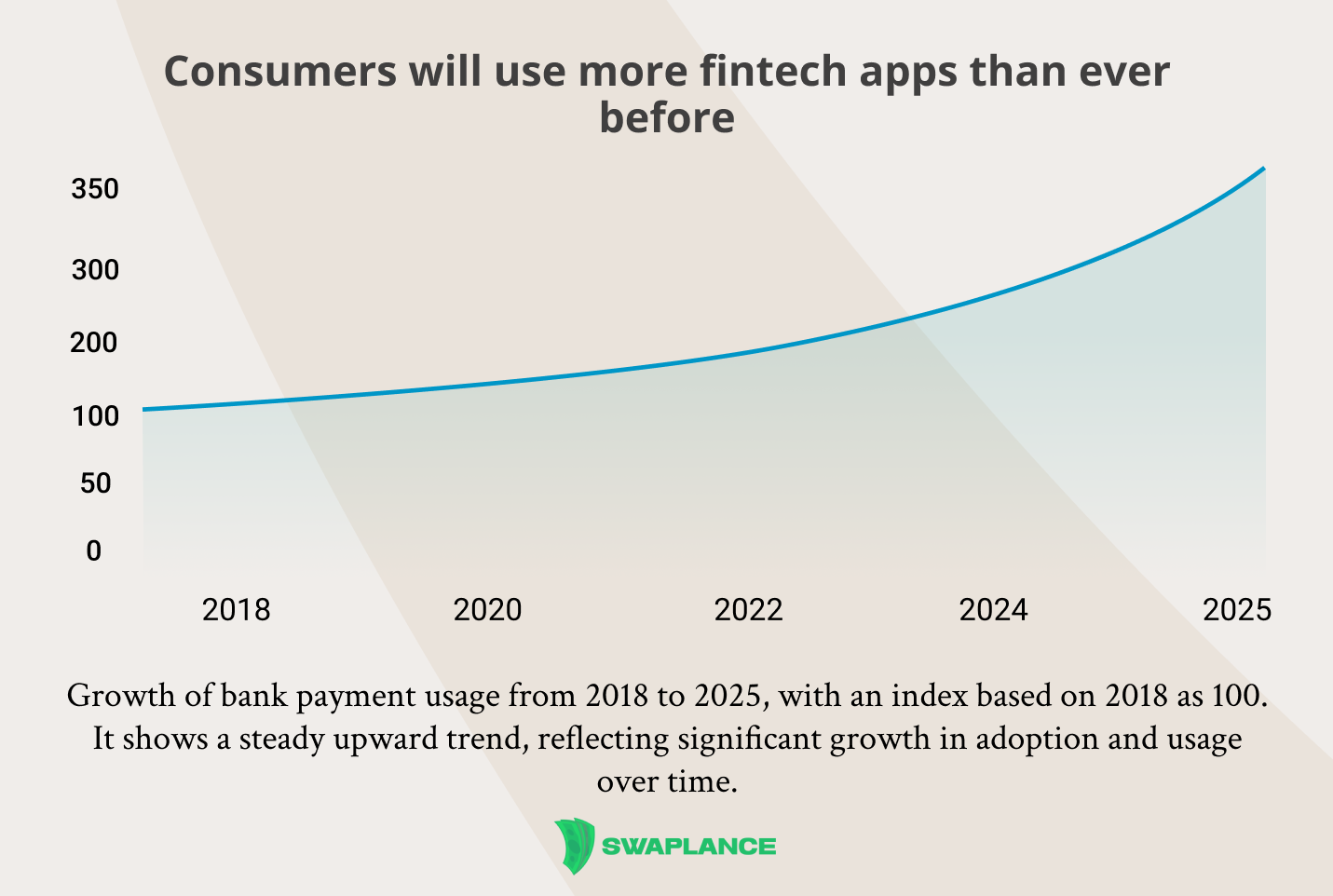

5. Bank Payment Usage Will Continue to Grow

Despite the rise of alternative payment options, bank payments remain a cornerstone of the financial ecosystem. With advances in online banking and digital payment solutions, banking industry trends show that more people are turning to banks for convenient, reliable transactions. Many traditional banks are investing heavily in technology to improve their payment processes, making them faster, more secure, and accessible to a broader audience. As consumers continue to trust bank-backed solutions, the usage of digital bank payments will likely see continued growth.

6. The Shutdown of Mint Drives New Innovation in Personal Financial Management

The shutdown of popular personal finance management tools like Mint has opened the door for new fintech innovation. Startups are seizing the opportunity to develop enhanced budgeting and financial planning apps that offer a more comprehensive view of one’s finances. These new solutions often feature better integration with various bank accounts, credit cards, and investments, allowing users to manage all aspects of their finances in one place. With them, fintech companies can develop advanced tools tailored to consumers' needs in an increasingly digital financial world.

7. Financial Identity Fraud Attempts Will Increase, but Identity Verification Solutions Are Stepping Up to Combat It

As digital finance grows, so does the risk of financial identity fraud. Current fintech trends highlight the increasing sophistication of fraud attempts, requiring fintech companies to strengthen security measures. Identity verification solutions are becoming a central focus, with biometrics, artificial intelligence, and blockchain technology being used to verify users and secure transactions. Fintech firms can protect their customers and maintain trust in digital financial services by adopting these advanced security solutions.

8. Loan Volumes Are Beginning to Trickle Back Up

After a period of decline, loan volumes are expected to increase as economic conditions stabilize. Trends in financial services suggest that fintech companies will play a significant role in facilitating these loans through peer-to-peer lending, crowdfunding, and digital credit platforms. These platforms allow consumers and businesses to access credit outside of traditional banks, making it easier for people to get loans without high interest rates or lengthy approval processes. Due to these processes, businesses can streamline loan processes and meet growing consumer demand.

9. AI Will Revolutionize How Consumers Manage Their Money

Artificial intelligence is transforming nearly every aspect of fintech, from personalized financial advice to fraud detection. AI-powered chatbots, robo-advisors, and smart budgeting tools make it easier for consumers to manage their money efficiently. Fintech innovations like these are expected to become even more advanced by 2025, providing users with insights tailored to their unique financial situation. As AI continues to evolve, consumers will have more control over their finances with minimal effort, and companies can develop even more personalized experiences with the help of AI.

10. Embedded Finance Will Define the Future of Fintech

Embedded finance is rapidly emerging as a game-changer in the financial landscape, transforming how consumers interact with financial services. By integrating financial services such as payments, lending, or insurance directly into non-financial platforms, businesses can offer seamless financial solutions to their users. This integration blurs the line between financial and non-financial industries, making financial transactions more accessible and embedded into everyday experiences. As embedded finance continues to evolve, it will play a pivotal role in the future of fintech, driving innovation and creating new opportunities for businesses to engage with customers in more meaningful and convenient ways.

The Future of Fintech: What Lies Ahead?

The future of fintech is filled with possibilities as emerging technologies redefine the industry. From AI and blockchain to biometrics and alternative payment solutions, fintech companies are pushing the boundaries of what’s possible. This continuous evolution of technology will make financial services more accessible, efficient, and secure for consumers and businesses alike.

The future of fintech is marked by rapid innovation and the integration of cutting-edge technologies. Advancements in artificial intelligence, blockchain, and digital identity verification will drive more secure, personalized, and efficient financial services. As consumer expectations for speed and accessibility rise, fintech companies will focus on creating seamless experiences through digital wallets, alternative lending platforms, and biometric authentication. Additionally, as financial inclusion grows globally, fintech will play a key role in reaching underserved populations, making financial services more accessible than ever. These trends indicate a future where fintech continues to transform how people interact with money, fostering a more connected, inclusive, and technology-driven financial landscape.

Common questions

-

What emerging technologies are expected to shape the fintech landscape in 2025?In 2025, emerging technologies like artificial intelligence (AI), blockchain, and quantum computing are expected to shape the fintech landscape significantly. AI will enhance personalized financial services, automate customer support, and improve fraud detection, while blockchain will drive transparency and security in transactions and data sharing. Quantum computing, though still in its early stages, could transform risk analysis and financial modelling by enabling complex calculations at unprecedented speeds. Additionally, biometric authentication and advanced digital identity verification methods will enhance security, making financial interactions safer for users. These technologies will collectively foster a more efficient, secure, and user-friendly fintech environment.

-

How will regulatory changes impact fintech innovations and consumer trust in the industry?Regulatory changes are expected to play a significant role in shaping fintech innovations and consumer trust. As governments and regulatory bodies introduce clearer guidelines and compliance standards, fintech companies will have a more stable framework to develop and launch new products, ensuring they meet safety and transparency requirements. This added oversight can increase consumer trust, as users will feel more secure knowing that fintech services adhere to strict regulations. However, increased regulations may also slow down innovation slightly, as companies must adapt to compliance needs. Overall, regulatory changes will likely balance innovation with consumer protection, fostering a safer fintech ecosystem.

-

What role will artificial intelligence play in enhancing customer experiences within fintech by 2025?By 2025, artificial intelligence (AI) is expected to transform customer experiences within fintech by offering personalized, efficient, and proactive service. AI will enable fintech platforms to analyze vast amounts of data in real time, allowing for tailored financial advice, personalized product recommendations, and more precise risk assessments. Through AI-driven chatbots and virtual assistants, customers will receive instant support, reducing wait times and enhancing accessibility. Additionally, AI will help fintech companies identify fraud patterns and detect transaction anomalies, improving security and building customer trust. Overall, AI will make fintech interactions more intuitive, secure, and customer-focused.

Mark Petrenko

Mark Petrenko