Artificial Intelligence in Finance and Banking: Transforming the Industry

The transformative power of Artificial Intelligence (AI) lies in its ability to process and analyze massive amounts of data, identify patterns, and perform tasks that traditionally required human intervention – all at a speed and scale that humans cannot match. This transformative potential is particularly evident in the finance and banking sector, where the complexity and volume of transactions demand highly efficient, accurate, and adaptive systems.

In finance, AI has revolutionized areas such as fraud detection, risk management, and investment strategy. Machine learning algorithms are trained to detect anomalies in real time, allowing financial institutions to identify fraudulent activities within seconds. This is a significant leap from traditional fraud detection methods, which often relied on manual audits and delayed responses. AI not only enhances security but also builds trust with consumers by reducing vulnerabilities.

For banking, AI transforms customer experiences through personalized and predictive services. Virtual assistants and chatbots, powered by natural language processing, provide instant support to customers, addressing queries ranging from account balances to loan applications. By analyzing customer data, AI systems can recommend tailored financial products, such as investment portfolios or credit card plans, increasing customer satisfaction and loyalty.

What is Artificial Intelligence?

Artificial Intelligence (AI) refers to the simulation of human intelligence by machines programmed to think, learn, and solve problems. In the context of finance, AI technologies are used to analyze vast datasets, predict market trends, and enhance customer experiences. But what is AI in finance, and why is it so important?

In simple terms, artificial intelligence finance solutions enable businesses to identify patterns, automate decision-making, and implement robust security measures. For example, AI systems power fraud detection in online banking by identifying anomalies in transactions. They also help investment firms assess risks more accurately, offering a competitive edge in financial decision-making.

The Intersection of AI and the Finance Sector

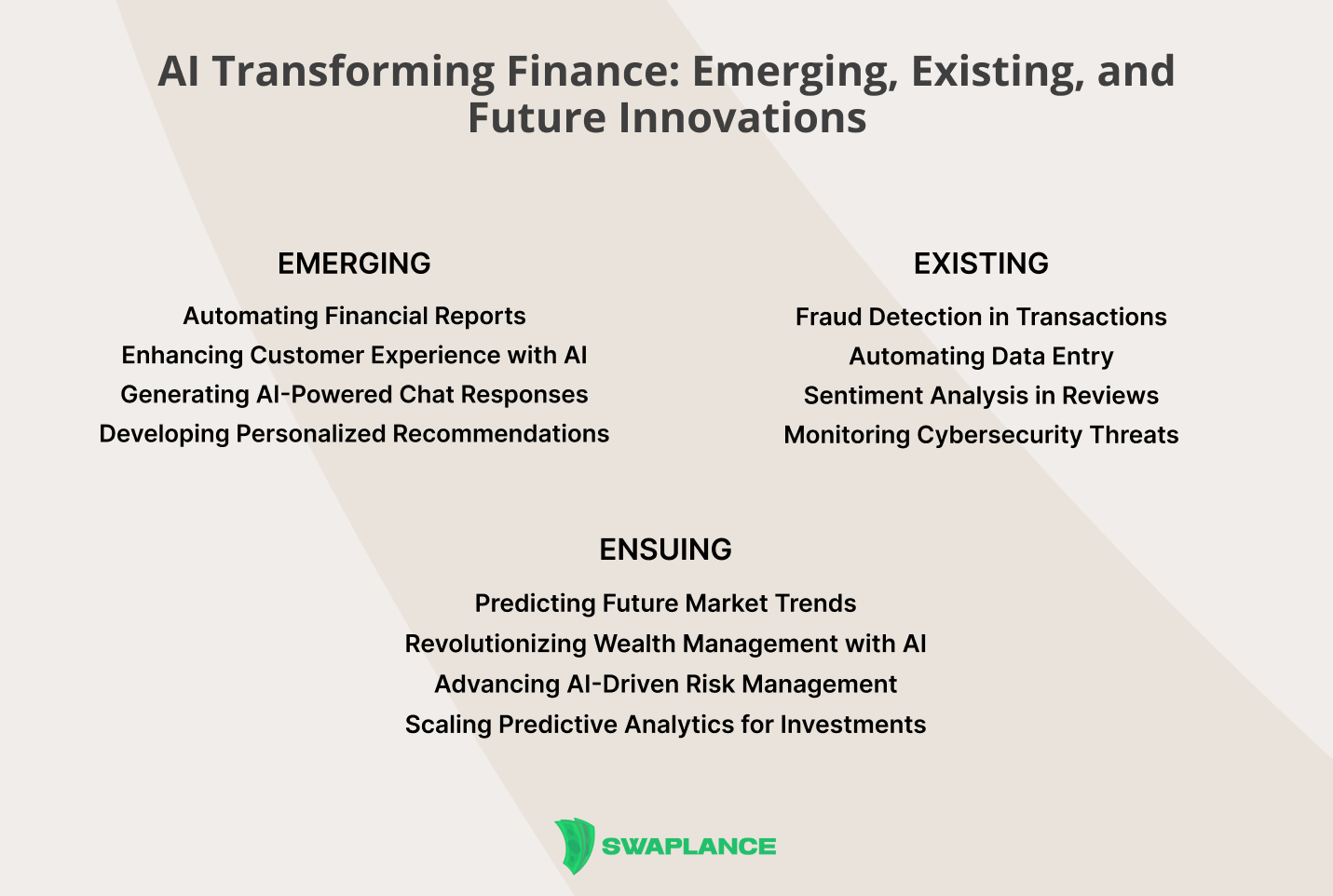

The growing adoption of AI in finance has revolutionized the sector by enabling smarter, faster, and more reliable decision-making processes. From robo-advisors managing investments to predictive analytics for credit scoring, AI is making financial services more accessible and efficient.

How is AI used in finance specifically? One key area is customer service, where chatbots and virtual assistants provide 24/7 support. Additionally, AI in banking and finance is employed to automate routine tasks such as loan approval processes and compliance checks.

AI-driven solutions are not only transforming retail banking but also creating new opportunities for financial institutions. Advanced algorithms are used to optimize portfolio management, minimize operational risks, and forecast market behavior with precision. By integrating AI in banking and financial services, businesses can stay ahead in an increasingly competitive market.

The Prospects of AI in Finance and Banking

The potential of artificial intelligence in finance is vast, with applications extending to almost every aspect of financial services. For example, AI-powered tools are revolutionizing AI in corporate banking, enabling businesses to improve efficiency and reduce costs. From algorithmic trading systems to credit risk modeling, AI is helping institutions drive better financial outcomes.

One of the most exciting aspects of AI is its ability to enhance financial inclusion. Automated underwriting processes, for instance, allow banks to offer loans to underserved populations who lack traditional credit histories. Similarly, AI in banking and financial services is transforming the payments ecosystem by facilitating faster and more secure transactions.

Looking forward, AI has the potential to reshape the way we interact with money, from personalized banking experiences to predictive financial planning tools. It’s evident that the future of finance lies in leveraging AI in corporate finance and other areas to innovate and streamline operations.

How Finance Experts Can Remain Relevant in an AI-Driven Landscape

As AI technologies advance, many financial professionals are concerned about how to adapt. The question arises: how to use AI in finance to complement human expertise rather than replace it?

The key lies in upskilling and adopting a collaborative mindset. Financial experts can capitalize artificial intelligence by focusing on areas that require human judgment, such as relationship management and strategic planning. For instance, AI can handle data analysis, but human expertise is still essential for interpreting the results and implementing them effectively.

Freelance platforms like Swaplance offer access to skilled AI specialists who can help businesses navigate this shift. By leveraging AI-driven solutions through collaboration, finance professionals can remain relevant and thrive in an ever-changing environment. Whether it’s AI in corporate finance or enhancing customer engagement, the human element will continue to play a critical role in ensuring the success of AI applications.

The integration of AI into finance and banking is not just a trend – it’s a fundamental shift that is redefining the industry. From automating processes to providing actionable insights, AI has become indispensable in driving efficiency, innovation, and customer satisfaction.

However, while AI offers immense opportunities, its success hinges on how well businesses and professionals adapt. By embracing AI solutions, leveraging expert platforms like Swaplance, and focusing on human-centric skills, finance professionals can position themselves for long-term success. As artificial intelligence in finance continues to evolve, those who capitalize on its potential will lead the way into the future.

Common questions

-

What are the primary applications of artificial intelligence in the finance and banking sectors?Artificial Intelligence (AI) plays a crucial role in transforming finance and banking through several key applications. In fraud detection, AI-powered systems analyze transaction patterns in real time to identify and prevent fraudulent activities. For customer service, virtual assistants and chatbots provide personalized, 24/7 support, streamlining client interactions. Additionally, AI enhances risk management by analyzing large datasets to assess creditworthiness and predict market trends, enabling better investment strategies and lending decisions. Its role in automating compliance processes and algorithmic trading also drives efficiency and cost savings for financial institutions.

-

How does artificial intelligence improve risk management and fraud detection in financial institutions?Artificial intelligence improves risk management and fraud detection in financial institutions by leveraging advanced algorithms to analyze vast amounts of data in real time. AI systems identify unusual patterns or anomalies in transactions, flagging potential fraud before it can escalate. In risk management, AI assesses creditworthiness, market trends, and potential losses by processing historical and real-time data, enabling institutions to make more informed decisions. Additionally, machine learning models continuously adapt and improve, enhancing their ability to detect sophisticated fraud schemes and mitigate financial risks effectively. This automation increases both accuracy and efficiency in safeguarding financial operations.

-

What challenges do banks face when integrating artificial intelligence into their existing systems?Banks face several challenges when integrating artificial intelligence into their existing systems. One significant hurdle is the compatibility of AI with legacy systems, which often lack the flexibility to support modern technologies. Data privacy and security concerns are also critical, as financial institutions must ensure compliance with stringent regulations while managing sensitive customer information. Additionally, the high cost of implementation, coupled with the need for specialized talent to manage AI systems, can strain resources. Lastly, addressing customer trust and transparency issues around AI decision-making remains a key challenge in adoption.

Mark Petrenko

Mark Petrenko