What is Stripe Payment? How It Works, Payment Methods, and Costs Explained

This article aims to give a comprehensive overview of the Stripe payment system, its functionalities, and its cost structure. Addressing questions like "What is Stripe Payment?" and "How does Stripe Work?" helps businesses understand why Stripe has become a leading player in online payment processing.

What is Stripe Payment?

Stripe is a financial technology platform that allows businesses to accept and process payments online. It provides the infrastructure for e-commerce platforms, subscription services, software as a service (SaaS) companies, and any business with an online presence to handle transactions securely. Stripe supports a wide range of payment methods, including credit and debit cards, digital wallets like Apple Pay and Google Pay, ACH transfers, and international payment options such as SEPA and Alipay. It simplifies the complexities of payment processing by handling security, compliance, fraud detection, and global transaction management. Its developer-friendly APIs make it easy to integrate with websites and apps, providing businesses with a seamless payment experience.

In essence, what is Stripe Payment? It is a versatile and developer-friendly platform that processes online payments, including credit cards, digital wallets, and more, making it a go-to choice for businesses seeking flexible payment options. In short, Stripe Payment is a comprehensive solution for businesses looking to manage payments effortlessly across various channels and currencies.

How Does Stripe Work?

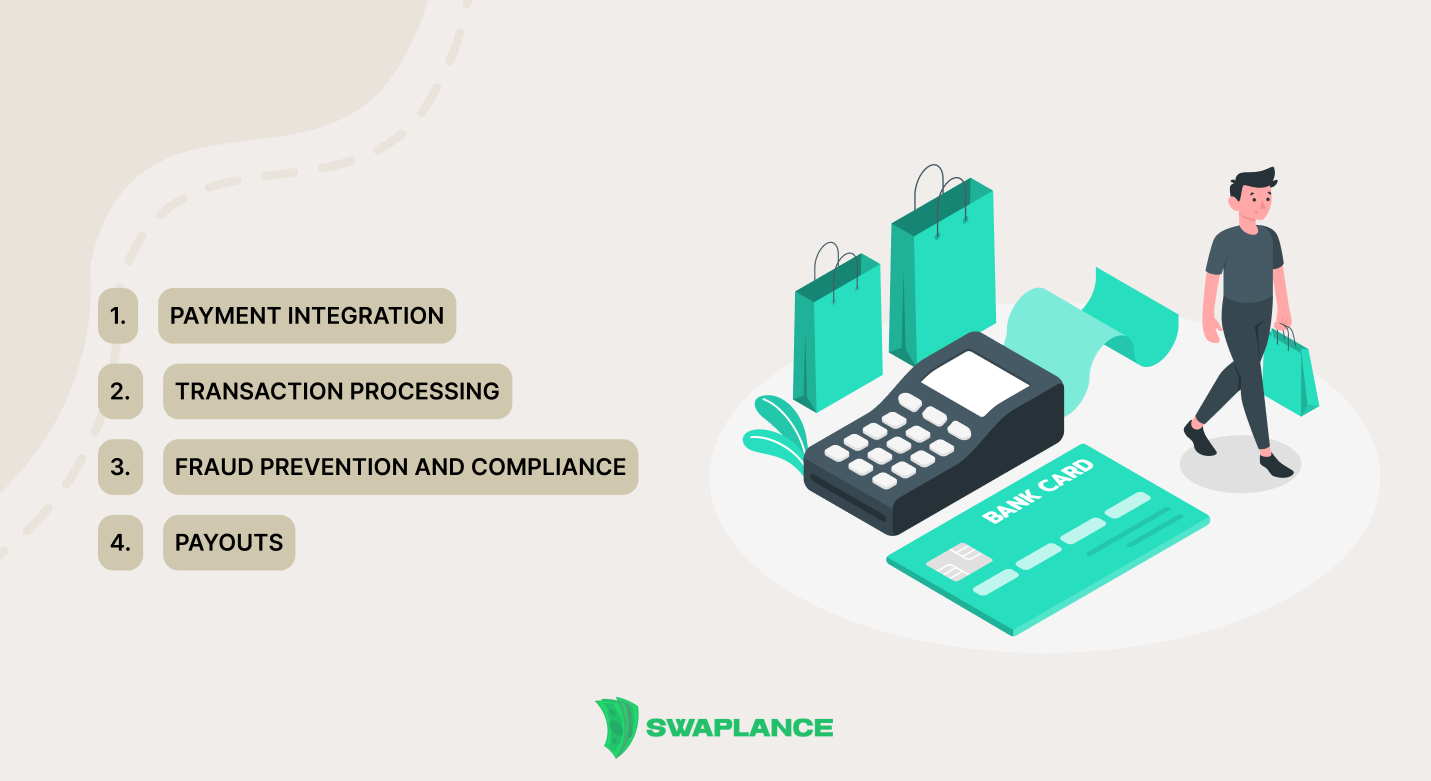

Stripe is a payment processing platform designed for businesses of all sizes, offering seamless integration of payment solutions. Here’s how does Stripe work:

- Payment Integration: Stripe provides APIs and pre-built tools for businesses to integrate payment processing into their websites, apps, or software platforms. Developers can easily implement Stripe into their systems, enabling businesses to accept payments via credit/debit cards, bank transfers, and digital wallets like Apple Pay and Google Pay.

- Transaction Processing: Once integrated, Stripe securely processes customer payments. When a customer initiates a payment, Stripe captures the payment details and sends the data to acquiring banks and payment networks. Stripe acts as the intermediary between businesses, customers, and financial institutions, ensuring that transactions are processed quickly and securely.

- Fraud Prevention and Compliance: Stripe includes built-in fraud prevention tools like Stripe Radar, which uses machine learning to detect and block fraudulent transactions. Additionally, Stripe handles all security and compliance requirements, such as PCI-DSS, ensuring that businesses meet regulatory standards without additional effort.

- Payouts: After payments are processed, Stripe automatically transfers the funds to the business's linked bank account, typically within a few days, minus transaction fees. Businesses can track their transactions and payouts in real time via the Stripe dashboard.

In essence, Stripe operates as a comprehensive payment processing system that allows businesses to accept, manage, and protect their online payments while simplifying the complexities of financial transactions. It acts as a middleman between merchants and financial institutions, ensuring payments are secure, processed quickly, and efficiently transferred.

What is Stripe Payment Method?

When it comes to understanding what is Stripe payment method, it's essential to recognize that Stripe offers various ways for customers to make payments. Stripe supports a range of payment methods, including credit and debit cards, ACH transfers, digital wallets such as Apple Pay and Google Pay, and even localized payment options like SEPA, Ideal, and Alipay, depending on the customer’s geographical location. This versatility allows businesses to cater to customers around the globe, offering them preferred payment options. Stripe also supports one-click payments, which enhances user experience and makes it easier for repeat customers to make purchases without re-entering payment details.

What Does Stripe Do?

To better grasp what does Stripe do, it’s helpful to view Stripe as a comprehensive toolkit for managing online payments. Beyond payment processing, Stripe offers a variety of additional services that help businesses grow and manage their operations efficiently. These services include invoicing, fraud prevention, analytics, and subscription billing. Stripe also offers a product called "Stripe Connect," which enables businesses to build their own marketplaces or platforms that process payments for third parties. Stripe’s versatility allows it to cater to startups, growing businesses, and large enterprises alike by managing complex payment flows, global expansion, and revenue streams.

How Much Does Stripe Charge?

Understanding how much does Stripe charge is essential for businesses considering the platform for their payment needs. Stripe’s pricing is straightforward: it charges a flat rate per successful transaction. For most businesses in the U.S., this is typically 2.9% of the transaction amount plus 30 cents for domestic credit card payments. International payments and those made with currencies other than USD may incur additional fees, typically around 1%. There are no setup, monthly, or hidden fees, making it a transparent option for businesses of all sizes. However, certain premium features like advanced fraud detection tools and in-depth financial reports may come with additional costs.

Who Owns Stripe?

Stripe was founded in 2010 by Irish brothers Patrick and John Collison. Both are highly involved in the company's day-to-day running. Under their leadership, Stripe has grown to become one of the world's most valuable private fintech companies, with a valuation in the tens of billions of dollars. Despite its rapid growth, Stripe remains privately owned, with the Collison brothers holding significant ownership stakes alongside venture capital firms that have invested in the company over the years.

In conclusion, Stripe is a comprehensive and flexible payment processing platform ideal for a wide range of businesses, from startups to large enterprises. It offers seamless integration, supports international payments, and provides a variety of payment methods tailored to global markets. Stripe's transparent pricing and advanced features make it a competitive option in the payments industry, empowering businesses to scale and manage transactions efficiently. Whether you're handling local or global payments, Stripe offers a reliable, developer-friendly solution for modern businesses.

If you're looking for expert guidance on integrating Stripe or other payment solutions, platforms like Swaplance can connect you with freelance experts who can assist with development and implementation.

Common questions

-

What types of businesses can use Stripe for payments?Stripe is versatile and can be used by a wide range of businesses, from startups to large enterprises. E-commerce platforms, subscription-based services, on-demand marketplaces, and even brick-and-mortar businesses that want to extend into online payments can integrate Stripe. Additionally, non-profits, crowdfunding campaigns, and Software-as-a-service (SaaS) companies can benefit from Stripe's tools for handling recurring billing, donations, and one-time payments. Its scalability makes it ideal for any business looking for a seamless online payment experience.

-

How do Stripe's fees compare to other payment processors?Stripe's fees are competitive compared to other payment processors, making it a popular choice for businesses. Typically, Stripe charges 2.9% plus $0.30 for every successful card transaction, similar to fees charged by PayPal and Square. However, Stripe stands out for not having monthly fees, setup fees, or hidden charges, which can be an advantage for businesses seeking a transparent pricing model. While other processors may offer tiered or volume-based pricing, Stripe’s flat-rate structure simplifies cost calculations, especially for small to medium-sized businesses. For international transactions, Stripe charges an additional 1% fee.

-

Can Stripe handle international payments?Yes, Stripe can handle international payments, making it a widely used solution for businesses operating globally. It supports over 135 currencies, allowing customers to pay in their local currency while businesses receive payments in their preferred currency. Stripe also offers multi-currency capabilities, dynamic currency conversion, and localized payment methods such as SEPA, iDEAL, and Alipay. Additionally, Stripe charges an extra 1% fee for international cards and another 1% for currency conversions, making it suitable for companies targeting a global customer base.

Mark Petrenko

Mark Petrenko