What is the Financial Services Industry? Overview, Key Sectors, and Market Impact

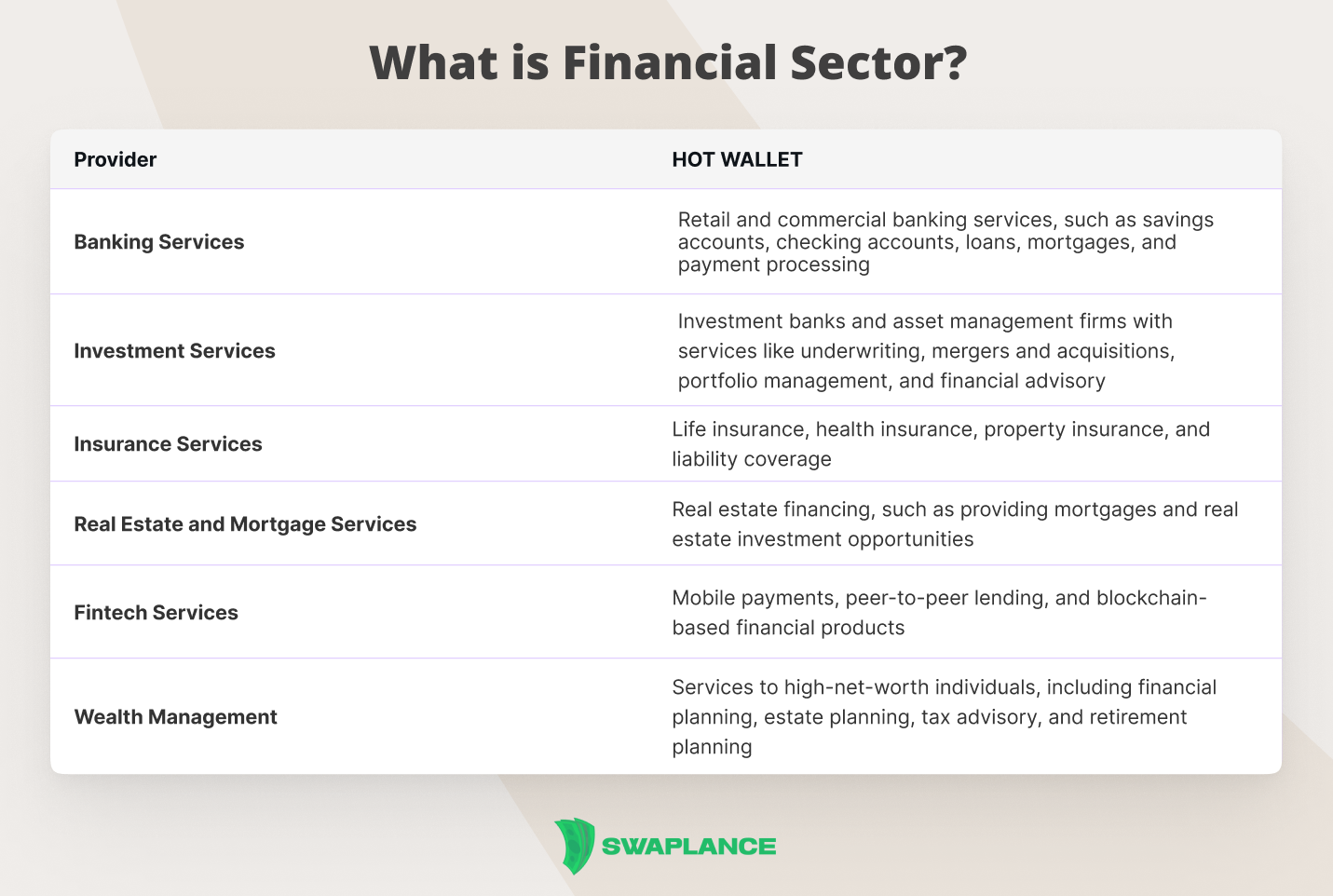

The financial services industry refers to a sector of the economy made up of firms and institutions that provide financial services to both individuals and businesses. This broad industry includes banking, investment services, insurance, real estate, wealth management, and fintech companies. Key functions of this industry involve managing assets, facilitating transactions, and offering financial advice to help people and businesses achieve their financial goals.

In essence, the financial services industry is integral to the functioning of global economies, enabling businesses to expand and consumers to manage their money efficiently through services like loans, savings, and investment products. As technology advances, this industry continues to evolve, with innovations like mobile banking, blockchain, and AI transforming how financial services are delivered.

Overview of the Financial Services Industry

A key focus of the financial services industry overview is the evolution brought about by digital innovation and the rising importance of compliance, risk management, and customer experience. Companies within this sector must balance the pressure of adhering to regulatory standards with the need for technological advancement. The financial services industry report often highlights the growing integration of IT solutions to streamline operations and meet customer demands.

The financial services industry encompasses a wide array of services and businesses that manage money for individuals, businesses, and governments. According to a financial services industry report, the industry includes sectors such as banking, insurance, investment management, real estate, and financial technology (fintech), and plays a critical role in the functioning of economies. The primary aim of this industry is to facilitate capital flow and provide financial products that assist consumers and organizations in managing assets, investing in new ventures, or securing their financial futures.

This industry is broad and diverse, consisting of traditional banking institutions, payment processors, insurance firms, brokerage houses, asset management companies, and even tech firms offering digital financial services. The financial services sector is vital for economic stability, as it enables access to capital, liquidity, and financial protection, supporting everything from daily financial transactions to large-scale infrastructure projects.

The industry is also closely regulated due to its importance in maintaining economic stability and safeguarding consumers. Regulatory bodies, both national and international, set guidelines to ensure transparency, risk management, and consumer protection. Technological advancements, such as blockchain, AI, and mobile banking services, are driving rapid innovation and shaping the industry's future.

Given its size and scope, the financial services industry is a critical pillar in modern economies, contributing significantly to global GDP while being central to innovation, economic growth, and the management of systemic risks. Companies seeking to build financial products or services can benefit from expertise in this complex field. Freelance experts on platforms like Swaplance can offer invaluable insights and support for financial industry projects, ranging from blockchain development to fintech solutions.

How Big is the Financial Services Industry?

The size of the financial services industry is massive, with trillions of dollars circulating through various global markets every day. When asking, how big is the financial services industry, it is important to consider its scope, which spans banking, insurance, investment management, and fintech. As of recent estimates, the global financial services market was valued at over $20 trillion, contributing significantly to employment, economic development, and the flow of capital.

The financial services industry is one of the largest and most influential sectors globally, with a significant impact on economies, both domestically and internationally. Its vast size is reflected in its contribution to global GDP, employment, and innovation across various sub-sectors like banking, insurance, investment, and fintech.

In terms of financial market capitalization, the industry controls trillions of dollars. For example, the global financial services market was valued at $22.5 trillion in 2021, and it's projected to grow to $28.5 trillion by 2025, demonstrating its substantial scale and growth trajectory. This encompasses activities from banking and asset management to insurance and stock market trading.

In the U.S. alone, financial services account for roughly 7.4% of the country’s GDP, showcasing the sector's critical role in the nation’s economic stability. Additionally, the sector is a significant source of employment. In the U.S., over 6 million people work within financial services, and the sector generates substantial tax revenues for governments worldwide.

This industry is expanding rapidly, particularly with the rise of fintech (financial technology), which is transforming traditional finance models by incorporating innovations like blockchain, AI, and mobile banking. This growth isn't limited to developed economies; emerging markets are also becoming key players in financial services, further contributing to the industry's size and importance globally.

Thus, the financial services industry remains a cornerstone of global economic infrastructure, fostering growth, investment, and innovation.

Trends in the Financial Services Industry

The financial services industry constantly evolves in response to technological advancements, regulatory changes, and shifting consumer behavior. In recent years, financial services industry trends have been dominated by the rise of fintech, increased use of artificial intelligence (AI), and the move towards open banking. Fintech companies have disrupted traditional financial models by offering faster, more cost-effective solutions.

Blockchain and cryptocurrency have also emerged as disruptive trends, with increasing interest in decentralized finance (DeFi). Examples include DeFi applications such as Uniswap and SushiSwap, which revolutionized cryptocurrency exchange. Both are decentralized exchanges that allow users around the world to exchange a variety of digital assets. Moreover, sustainability and socially responsible investing (SRI) are gaining traction, driven by a demand for greener, more ethical investment options.

Additionally, regulatory technology (RegTech), which is the application of emerging technology to improve the way businesses manage regulatory compliance, is helping companies comply with ever-stricter regulations. RegTech companies like Elliptic or Mitratech provide technology-based solutions that help financial institutions comply with regulations. Their solutions monitor compliance in real time, reduce compliance costs, and enhance compliance efforts' accuracy and effectiveness. So, FinTech companies can be focused on developing innovative financial products and services that provide a better customer experience. At the same time, machine learning and AI are being applied to improve risk management and customer service. Cloud computing and big data allow institutions to optimize their operations and enhance security.

IT Services for the Financial Industry

As financial institutions undergo digital transformation, IT services for financial industry players have become indispensable. These services range from cybersecurity to cloud solutions, digital payment platforms, and data management systems. IT services not only improve operational efficiency but also enhance the customer experience by offering more seamless, secure, and flexible services.

Banks and financial companies rely on advanced IT infrastructure to support digital payments, real-time banking, mobile applications, and fraud detection. Cybersecurity remains a top priority, as the growing reliance on digital platforms increases the risk of data breaches and cyberattacks. Additionally, IT services enable banks to comply with stringent regulations by offering robust reporting, monitoring, and auditing tools.

Fintech companies are leading the charge in innovation, using IT services to deploy blockchain technology, AI-based algorithms, and open banking solutions. The collaboration between traditional financial institutions and IT service providers is crucial to the future of the financial services industry, as it ensures security, scalability, and continued innovation.

In conclusion, the financial services industry is a cornerstone of global economic activity, shaping how businesses and individuals manage their financial lives. As technology continues to reshape this sector, staying updated on market trends, innovations, and IT services will be vital for companies and consumers alike.

Common questions

-

What are the main sectors within the financial services industry?The financial services industry consists of several key sectors that facilitate the management and movement of money. Banking encompasses commercial banks, investment banks, and credit unions, offering services such as deposits, loans, mortgages, and other credit products. The insurance sector includes life, health, property, and casualty insurance, providing risk management solutions to both individuals and businesses. Asset management firms handle investments for individuals and institutions, managing mutual funds, pension funds, and hedge funds. Capital markets involve stock exchanges, securities trading, and financial intermediaries that enable the buying and selling of stocks, bonds, and other financial instruments. Fintech, a rapidly growing sector, focuses on digital financial services, including mobile payments, online banking, and blockchain technology. Each of these sectors plays a critical role in the overall economy by facilitating financial transactions, managing risk, and supporting investment and growth.

-

How does the financial services industry impact the global economy?The financial services industry significantly impacts the global economy by facilitating the flow of capital and supporting economic growth. It helps businesses access funding through banking, investment, and lending services, which are essential for expansion and innovation. The industry also plays a critical role in personal wealth management and consumer spending, contributing to overall economic demand. Furthermore, by offering risk management solutions through insurance and investment diversification, it helps stabilize financial markets and reduces volatility, making the global economy more resilient to financial shocks. Finally, advancements in financial technology (fintech) are increasing accessibility and efficiency, further stimulating global economic integration.

-

What are the challenges currently facing the financial services industry?The financial services industry is currently facing several challenges, including increased regulatory scrutiny and compliance demands, which can lead to higher operational costs. Cybersecurity threats are also a significant concern, as financial institutions manage large amounts of sensitive data, making them prime targets for cyberattacks. Additionally, the rapid pace of technological innovation presents both opportunities and challenges, with many firms needing to invest heavily in fintech solutions to remain competitive. Lastly, changing customer expectations, particularly a demand for more personalized and digital experiences, requires institutions to continually adapt and improve their offerings to meet evolving market demands.

Mark Petrenko

Mark Petrenko